All New Financial Architecture Articles

How capital is being reallocated and repriced in the post-2020 regime. Where money flows, what is being repriced, and who controls the new financial plumbing.

59 articles

Gold Whipsaws as Safe Haven Calculus Breaks

Silver plunged from $120 to $89 per ounce in days, erasing January's record run. Gold rallied 5% off recent lows. The metal markets are convulsing not from supply shocks but from a more fundamental crisis: investors can't agree on what constitutes a store of value when the Fed holds rates steady under political siege, the dollar strengthens on Venezuela intervention fears, and Treasury yields signal economic confusion.

Senate Delays Crypto Vote as $6B Stablecoin Fight Intensifies

The Senate postponed its January 15 markup of comprehensive crypto legislation, pushing the vote to late January after failing to secure bipartisan support. The delay centers on whether crypto exchanges can offer rewards on stablecoins—a $6 billion question that has fractured the industry coalition built around regulatory clarity. Meanwhile, Wyoming launched the nation's first state-backed stablecoin, and liquidity is returning to markets after December's risk-off period.

Crypto Clarity Bill Momentum: What Republicans, Tim Scott, and Markets Are Watching

A Senate effort to define crypto under securities law has picked up unexpectedly broad attention: Republicans weighing political optics, Senator Tim Scott’s draft as the procedural hinge, and traders pricing regulatory re-risk into exchange listings and venture exits. The outcome will determine who regulates, which tokens survive, and how quickly capital reallocates.

Why Annaly's Yield Is a Beacon for Subordinated REITs

BTIG's recent upgrade of Annaly Capital Management reframes the payout calculus for mortgage REIT investors. With core spreads compressed but book-value resiliency intact, capital is likely to flow into subordinated securities that still trade at meaningful yield premia—tightening credit curves and lifting relative prices across the sector.

California’s Billionaire Tax: Redistribution or Innovation Tax?

California’s proposed billionaire tax would levy a supplemental surcharge on ultra-high-net-worth residents to fund housing, climate and education. Proponents call it corrective redistribution; critics warn it taxes dynamism—raising the cost of failure for founders and possibly shifting wealth and risk offshore.

Veradermics IPO Brings Hair-Regrowth Bets into the Public Market

Veradermics’s IPO opened a public window on hair-regrowth biotech, selling a narrative of durable follicles and scalable clinics while forcing investors to price clinical risk, reimbursement dynamics, and narrow commercial moats into a single ticker. The offering tests whether aesthetic medicine can finance long-term biologic programs outside the traditional oncology and rare-disease corridors.

Rotation to Value-Like Mass-Market Stocks Looks Durable — But Microcap Speculation Is Risky

A noticeable shift is underway: capital is moving from high-multiple growth into large, cash-rich consumer and industrial names that behave like 'value' without being arcane. That rotation may persist while policy uncertainty remains high, but microcaps whose narratives depend on whispered rule changes deserve heightened skepticism.

When the Nasdaq-100 Rewrites Itself, Who's Listening?

The Nasdaq-100’s reconstitution used to be an institutional heartbeat. Today, retail trading apps, index funds and passive ETF flows amplify that pulse. The result: index flows are increasingly both signal and driver, reshaping price discovery and elevating rebalances from mechanical housekeeping to market-moving events.

Mortgage Rates Retreat Below 6% as Ally of Trump Frames Bond Buying as 'A Start'

Mortgage rates slipped under 6% this week, easing pressure on homebuyers and refi candidates. The move tracks lower Treasury and MBS yields and coincides with a public endorsement from a close Trump ally who described recent agency mortgage bond purchases as 'a start'—a phrase that markets interpreted as potential for more policy support.

The 10% Credit-Card Cap: Relief That Could Close the Door on Riskier Borrowers

A statutory 10% cap on credit-card interest rates would lower borrowing costs for many cardholders but distort the economics of unsecured lending. Banks will respond by tightening approvals, reallocating costs to fees, or redesigning risk exposure; the likely net effect is narrower access for higher‑risk consumers and a shifting of financial burden rather than its elimination.

Copper Breaks $13,000: US Demand Sets Off a Global Rally

Copper surged past $13,000 per metric ton as stronger-than-expected U.S. manufacturing and infrastructure spending collided with limited new supply. Traders, miners and policymakers are recalibrating: the rally tightens the metal’s role as both an inflation barometer and a geopolitical lever.

Frozen Funds and Rising Risk Premia: How Trump-Era Signals Are Rewiring Markets

Markets are repricing political risk after the Treasury froze roughly $10 billion earmarked for Democratic-governed states on fraud concerns. Add tariff rhetoric and a pending Supreme Court decision that could reshape regulatory reach, and risk premia—especially for municipal credit, trade-exposed sectors and regulated monopolies—have begun to diverge along political lines.

Hg Capital Nears Take-Private of OneStream, Private Equity Reaffirms Software Moat Thesis

Hg Capital is close to completing a take-private of OneStream, the corporate performance-management software vendor, in a deal that crystallizes private equity’s continuing hunger for enterprise software: predictable cash flows, high retention, and integration complexity that together form a 'durable software moat.' The move illuminates how PE firms price and scale software franchises today.

Jollibee Plans U.S.-Listed Spin-Off of International Arm by 2027

Jollibee Foods Corporation is preparing to separate and list its international operations on a U.S. exchange by 2027. The move signals a shift from APAC-centric scaling to a dual-market capital strategy intended to re-rate growth with U.S. public-market multiples while keeping the domestic Filipino business insulated.

TheraVectys Weighs Hong Kong IPO to Tap Asia’s Deep Capital Pools

TheraVectys, a France-based immunotherapy company, is considering an initial public offering in Hong Kong—an intentional bid to reach Asia's deep growth capital and broaden its investor base beyond Europe and the U.S. The plan, if executed, would illuminate a practical path for non-Chinese biotechs seeking liquidity and strategic partnerships in Asia.

When Caracas Calms: How Venezuelan Debt Could Rebound on a Policy Turn

Distressed Venezuelan sovereign debt prices are a map of political risk. If a transitional government stabilizes policy and secures oil revenues, defaulted and deeply discounted bonds could rerate sharply; yet investors should treat recovery scenarios as oil‑sensitive event trades rather than permanent reallocations.

A Regulatory Window: U.S. Signals Toward Rules for Crypto and AI

U.S. policy conversations are coalescing around a narrow but real window for regulated innovation in crypto and AI: clearer rules, synchronized standards with allies, and tax frameworks that reduce capital flight. The shift would not be laissez‑faire — it is an engineered corridor for growth, not an invitation to risk-free experimentation.

When Buyouts Rewrite Insurance: PE Restructurings and a Tightening Specialty Market

A wave of private-equity-led restructurings in specialty lines is compressing credit availability, altering underwriting incentives, and elevating the chances that policyholder protections and state guaranty funds will be the last line of defense.

Hedge Funds Poise for Crypto ETF Wave as Regulatory Fog Lifts

Hedge funds are positioning for a likely cascade of spot crypto ETF approvals. As market-structure ambiguity fades, managers expect lower regulatory risk premia, making allocations to bitcoin and a curated set of altcoins more defensible to fiduciaries and allocators.

GOP Regulator Takeover: Wall Street Watchdogs Tilt Toward Deregulation in 2026

In 2026 the GOP’s control of key regulatory posts is reshaping American financial oversight: fresh appointees to the SEC, CFTC and banking agencies are prioritizing lighter reporting, looser enforcement, and a hands-off posture toward novel markets. The shift favors capital allocation but raises systemic-risk and investor-protection questions.

China’s 8 Million Ton Soybean Purchase: A Partial Pledge, Full Market Ripples

China bought roughly 8 million metric tons of U.S. soybeans this month in what traders call a partial fulfillment of earlier purchase pledges. The order steadied futures, tightened nearby export availability, and forced a reprice across global vegetable-oil and protein markets.

Gilead’s Medicaid Exposure Is Contained; Biktarvy Still the Engine

A potential Medicaid price pressure was widely feared; instead, the financial exposure looks limited. Meanwhile Biktarvy — Gilead’s single-tablet HIV regimen — continues to drive revenue with modest downside from price erosion and predictable volume dynamics.

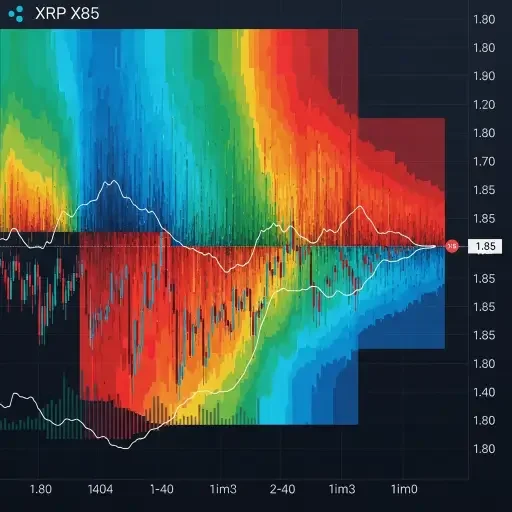

Liquidity, Not Luck: XRP’s 1.85 Dip and the Quiet Pressure on Rebound

XRP trades at 1.85, holding just above 1.80 support after breaking 1.87. The move narrows the market’s focus to liquidity dynamics and the pace of incoming exchange flows, as macro risk lingers and traders reassess risk premia. If liquidity tightens, a rebound may stall; if it loosens, downside risk could fade with a sharper tempo.

Transforming Faults into Forecasts: San Francisco’s Power Outage Rewrites Energy Reliability

A sweeping outage in San Francisco exposes vulnerabilities in the region’s energy grid while accelerating a market dialogue about resilience. Utilities, policymakers, and investors watch as failure morphs into a framework for reliability, pricing, and strategic reform.

Transforming Privacy: New York Vetting Health Data Triggers a National Conversation

New York authorities are re-sizing the risk lens on health data, inspired by Florida’s aggressive privacy posture. As policymakers tighten scrutiny of datasets, healthcare providers, tech platforms, and insurers confront a shifting economics of data—one where consent, provenance, and protection must align with a rapidly expanding value chain.

Where Capital Takes Holiday

From Aspen's private ski chalets to Caribbean estates accessible only by seaplane, the finance elite retreat to enclaves where luxury is measured not in thread count but in absolute privacy.

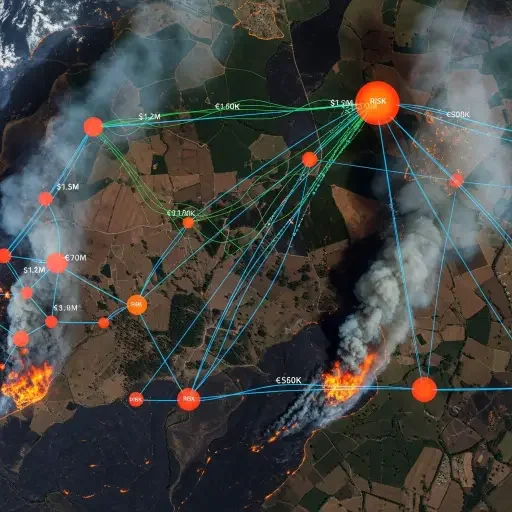

Climate Risk as Financial Friction

Catastrophe bonds tied to wildfires are expanding faster than the actuarial frameworks designed to price them, driven by geospatial analytics that reduce uncertainty but challenge traditional rating methodologies.

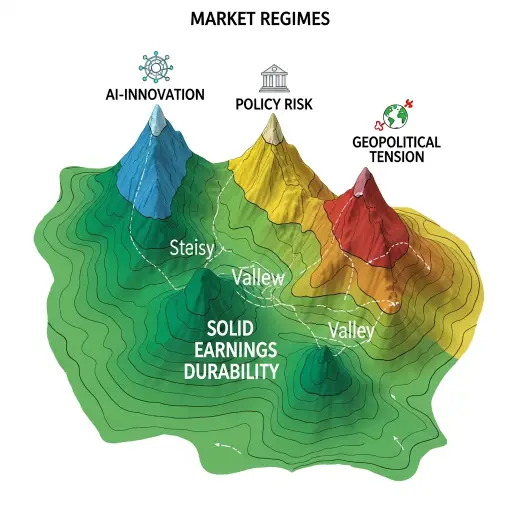

The Great Paradox: Low Inflation, High Volatility

As 2025 concludes, a market dissonance emerges: consumer inflation cools, yet asset instability accelerates. This divergence signals a regime shift where volatility is driven not by monetary policy, but by three structural forces: the regulatory fragility of AI, the capital intensity of the energy transition, and persistent geopolitical friction.

Bitcoin Long-Term Holders: The Cycle That Won't Break

Long-term Bitcoin holder supply just hit an 8-month low. But unlike 2017 or 2021, this isn't the climactic selling that marks cycle peaks—it's the third wave of distribution in a pattern that's rewriting the playbook.

Fogo Chain vs. Ethereum: The L1 That Wants to Run the Trading Floor

Fogo Chain positions itself not as a general-purpose blockchain, but as market infrastructure—an L1 optimized for speed, determinism, and trader-grade execution in ways Ethereum was never designed to be.

When the Roomba Stopped: How iRobot's Fall Rewrites the Survival Manual for Robotics

iRobot's Chapter 11 filing marks the end of a 35-year journey from MIT innovation to Chinese acquisition—a trajectory that exposes brutal truths about capital, competition, and survival in global robotics.

When Everyone Else Falls: Tesla's Quiet Defiance in a Tech Bloodbath

On December 12, 2025, as AI infrastructure fears crushed the Nasdaq, Tesla surged 2.5% while its tech peers hemorrhaged value—a complete inversion of the market's direction. The divergence exposes a market quietly rotating toward a different kind of AI story.

The Silent Handoff: Bitcoin’s ETF Era and the New Architecture of Exit Liquidity

As Bitcoin ETFs accumulate millions of coins and early whales distribute long-dormant holdings, the structure of the crypto market has shifted. The deeper question is whether this shift marks a slow-motion wealth transfer or the maturation of a once-insurgent asset into something more predictable.

Engineering Market Perception: How Fragmented Fed Communications Trigger Near‑Certainty Cuts and Recalibrate Risk

When central-bank signaling forks from market expectation, a small policy surprise reverberates through asset prices as if convexity had been unlocked. This piece dissects the mechanism, the sequence of consequences, and the practical hedges for investors navigating a regime shift where a 25bp rate cut, paired with sticky inflation, reshapes the risk landscape.

Modeling a Deflationary Wave: How China’s PMI Contractions Could Rebalance Global Commodities

Eight months of PMI under 50, a stubborn compression in domestic demand, and a mechanistic link to oil, copper, and iron—this is not prophecy but a structured forecast built from simple, testable channels. This article dissects the transmission paths, calibrates a probabilistic baseline, and sketches the likely price and demand contours for global commodities through the next few quarters.

Datco Drama: Corporate Treasuries as Leverage Experiments in Bitcoin, ETH, and Reputation

A mountaintop view of the Datco drama: Strategy-led balance sheets, public tickers, and a social experiment in leverage. When treasuries hold digital assets, every earnings call doubles as a referendum on trust, discipline, and narrative capital.

CNI Upgraded, Railcar Quietly Marshals Gains: The Quiet Engine of Small-Cap Logistics

A once-obvious-but-underappreciated truth: in logistics, the railroad is the system’s nervous system. When a major operator shifts from neutral to favorable, it doesn’t just move cars; it reorders probabilities for a cadre of small-cap beneficiaries—the suppliers that feed the network and the lessors that bankroll its cadence.

Mapping the Quiet Stall: 90 Million Vacant Chinese Apartments as a Global Slowdown Signal

A vast inventory of unsold and unoccupied housing in China hints at a macro shift: demand fatigue, policy recalibration, and a potential cascade into global growth. This piece traces the architecture of that risk—from local credit megaphones to international capital channels—and translates vacancy into a new climate for investors and policymakers alike.

Designing Quiet Cross-Border Wins: Carlyle’s Two-Japan Prelude

In the margins of Tokyo’s boardrooms and New York’s conference calls, Carlyle is quietly prepped to close two deals in Japan. The stakes aren’t merely financial: they’re architectural, signaling how cross-border capital meets domestic strategy in a market famous for patience, nuance, and a stubbornly local tempo.

Entropy-Driven Bitcoin: The 2026 Bear Market Crossroads—$30k, $50k, or a Faster Recovery

As 2025 closes with Bitcoin retreating from October's $126k all-time high to current levels near $86k, the question shifts forward: in 2026, will we see a deeper retracement to $30k, stabilization around $50k, or a faster-than-expected recovery that defies bear market timelines? This piece threads the data—hash-rate resilience, macro liquidity, on-chain activity, and sentiment—to decode the signals that will shape Bitcoin's next chapter.

Designing Entropy-Aware Allocations: How New Altcoin ETFs Could Rewire Crypto Portfolios

New exchange-traded funds rooted in altcoin baskets promise to alter how institutions and high-net-worth investors tilt crypto allocations. By packaging XRP, SOL, LINK, and related assets into diversified sleeves, these ETFs aim to shift risk, liquidity, and correlation profiles. The question: will this rewire portfolios or merely rebrand them?

Antifragile Markets in a Cyberpunk Baroque

A high-dimensional phase transition is remaking the rules of money, power, and policy. This article sketches a concise map: metastable economies, bifurcating politics, and a social contract tilted toward the few who command liquidity and code.

Gold, Bitcoin, and the New Reserve Debate: What Central Banks Buying Gold Really Signals

Central banks are quietly recalibrating monotone commitments to fiat stability by expanding gold reserves and positioning cryptocurrencies as counterweights to traditional anchors. This piece untangles what those moves reveal about trust, legitimacy, and the future of monetary architecture.

Trafficking Crisis: Global Black Market Nets 9 Big Cats Each Month

Nine big cats seized each month. A global supply chain powered by desperation, greed, and porous borders. This is not merely wildlife crime; it's an information bottleneck in motion, a field test for enforcement, demand reduction, and resilience of ecological memory. We trace the data, expose the architecture, and sketch the levers that could restore balance.

Reading the Signals: American Signature's Bankruptcy as a Beacon for Retail's Fragile Home Goods Demand

A bankruptcy filing from American Signature has become more than a corporate hiccup; it’s a diagnostic signal of a broader strain in the home goods segment. This article traces the mechanism: why a single retailer’s distress foreshadows sector-wide softness, how consumer credit, discretionary spending, and inventory dynamics interact, and what investors should infer about retail resilience in a high-inflation, rate-tight environment.

Entropy, Attractors, and the Capital Arcades: How Markets Read the AI Inflection

Three mathematical forces collide as capital teeters between acceleration, reversion, and risk — a narrative stitched from data, drama, and the dampening hum of central banks.

Tether’s Gold Land Grab: Building a Modern Fort Knox for Fiat-Debasement Era

Tether, the ubiquitous stablecoin conglomerate valued around half a trillion dollars, is expanding beyond exchanges and wallets. It is acquiring stakes in gold royalty companies—Elemental Altus and EMX Royalty—to assemble a modern Fort Knox. This isn’t merely diversification; it’s a strategic architecture for stability in a world of fiat debasement, where Bitcoin and physical gold are positioned as twin backstops. The playbook blends balance-sheet precision with macro-geopolitical optics.

Streaming Wars 2.0: Netflix, Comcast, and Paramount in War for Warner Bros.

Warner Bros. stands at the pivot of an accelerating scramble among Netflix, Comcast, and Paramount. Each player leverages scale, bundle economics, and data-rich leverage to turn WB’s catalog into an operating system for streaming momentum—and every decision reshapes the balance of power in a converging media ecosystem.

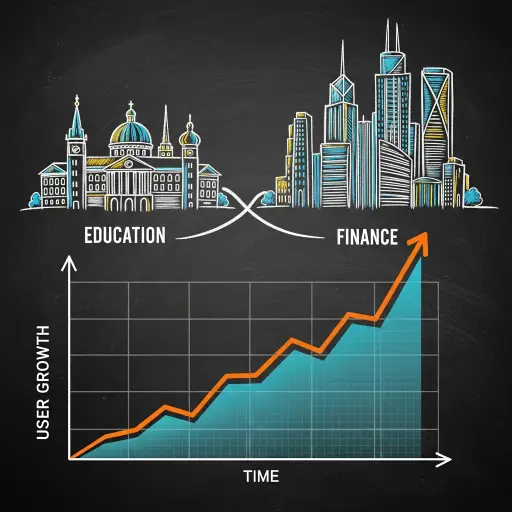

IPO: How Physics Wallah Orchestrated a $5B EdTech Market

How a single, audacious educational platform mapped a failure-to-access problem into a scalable, investor-ready engine, transforming a classroom into a public-market phenomenon.

Agilent’s Quiet Alchemy: The Pick-and-Shovel Bet Powering Biotech’s Boom

In biotech’s roiling theater, Agilent Technologies (A) operates as the backstage infrastructure: instruments, systems, and consumables that convert bold science into measurable outcomes. This is not a story of flashy breakthroughs; it’s a ledger of reliable enzymes—precise, portable, indispensable. The stock whispers less than it shouts, but its performance hums: roughly 13.44% annualized returns over ten years, a quiet arithmetic of compounding in a world that often smells like overhyped science and underwritten risk.

Entropy in the Shadows: Ackman Presses Pause on Fannie/Freddie Privatization

Bill Ackman signals a cooling of jets on privatizing Fannie and Freddie, framing the current moment as ‘the political climate’—coded language for power, cash streams, and a Treasury reluctant to relinquish the cash cow.

The $13 Billion Bitcoin Dispute: Decoding China's State-Hacking Accusation Against the US

China's cybersecurity agency has accused the United States of orchestrating a 2020 hack that stole 127,000 Bitcoin, now worth $13 billion, then seizing the coins under law enforcement pretenses. The US maintains it lawfully confiscated criminal proceeds. The conflicting accounts reveal deep fractures in international cyber attribution and digital asset sovereignty.

Crypto at the Edge: How the U.S. Government Shutdown Rewired Digital Markets

The 2025 U.S. government shutdown revealed a deep coupling between political paralysis and crypto volatility—showing how digital markets now echo the pulse of institutional confidence.

The Tariff Peak: Why the Trade War Is Eating Itself

Trade conflicts follow a predictable thermodynamic arc from escalation to exhaustion. Game theory, corporate margin compression, and consumer inflation are now converging to signal 'peak tariff'—the point at which a high-energy, inefficient policy collapses under its own weight. This is the map of the inevitable retreat.

Bitcoin's Bear Market: Whales Retreat as Institutional Dream Meets Reality

Bitcoin crashed through the psychologically crucial $100,000 level on November 5, 2025, marking its first breach since late June and confirming entry into bear-market territory. The 20% plunge from October's record high of $126,198 has erased nearly all of 2025's gains, driven by massive whale liquidations totaling $45 billion, institutional ETF outflows exceeding $577 million daily, and vanishing retail demand. PayPal co-founder Peter Thiel's prescient warnings about Bitcoin's 'co-option' by BlackRock now haunt the market as his prediction of limited upside and volatility materializes with stark precision.

Ripple & XRP: From Regulatory Uncertainty to Institutional Powerhouse – Why Smart Money is Piling In

With the SEC lawsuit dismissed, spot ETF infrastructure launching, and a $500 million Citadel-led round valuing Ripple at $40 billion, XRP has shifted from regulatory outlier to institutional-grade asset backed by Wall Street market makers.

The Shadow Banking Reckoning: Why Private Credit's $2 Trillion Blind Spot Threatens Markets

A $2.1 trillion private credit market built on covenant-lite loans, mark-to-model valuations, and quarterly liquidity promises is testing the limits of shadow banking—raising the odds that a TCW-style warning becomes the trigger for systemic stress.

The Caribbean Triad: How Venezuela’s Geography and Power Politics Could Ignite the Next Western Hemisphere Crisis

Venezuela’s 2025 power consolidation, U.S. sanctions strategy, and militarized signaling are compressing decision time across the Caribbean lanes, the Orinoco oil heartland, and the Guayana Esequiba frontier—creating a triad where economic coercion and geography intertwine to heighten crisis risk.

The Great Consolidation: Inside the New Wave of Global M&A and Private Capital Power Plays

Falling rates and voracious private capital are reviving mega-deals—from Kimberly-Clark’s $48 billion pursuit of Kenvue to Vertiv’s $1 billion liquid-cooling expansion and Ares Management’s continuation fund strategy—signaling a reorganization of corporate power for the post-tightening era.