Every quarter the Nasdaq-100 tells the market which companies have earned a place on its stage. That decision, mechanically enforced by a rulebook and executed by index providers, used to produce a predictable ripple: some trading, a few rebalancing trades by active managers, then a return to fundamentals. The drumbeat has changed. Commission-free trading, fractional shares, and a proliferation of ETFs have connected retail order flows to index events in ways that make the reconstitution itself an information event—not just a bookkeeping moment.

Why this matters: indices were designed to summarize markets, not to command them. When capital allocators respond to index weight changes, that response can be informative—reflecting reweighting of risk exposures. When flows are mechanically driven, however, they can distort prices, compressing the time available for fundamental information to be absorbed. The contemporary Nasdaq-100 reconstitution sits at that intersection: signal and mechanical demand are now entangled.

The mechanics are simple to state and messy in outcome. Inclusion and exclusion create demand: new entrants must be bought by index funds and ETFs that track the Nasdaq-100; exits are sold. Passive vehicles don’t pause to underwrite firms or parse forward guidance; they transact to match weights. That plumbing used to be dominated by institutions with large, patient blocks and bespoke execution. Now it is shared with retail brokers whose clients trade in smaller, immediate units—and with platforms that route orders through dark pools, internalizers, and high-frequency market makers.

Two empirical shifts make the reconstitution more consequential. First: the scale and speed of ETF capital. Passive shares have swelled to absorb a far larger share of daily volume; the largest Nasdaq-100 ETFs now act as omnibus conduits for millions of retail and institutional investors. Second: retail behavior is less sticky. Fractional trading reduces frictions; social-media-driven attention can concentrate orders into narrow windows. The combination magnifies intraday demand spikes around rebalance announcements and implementation dates.

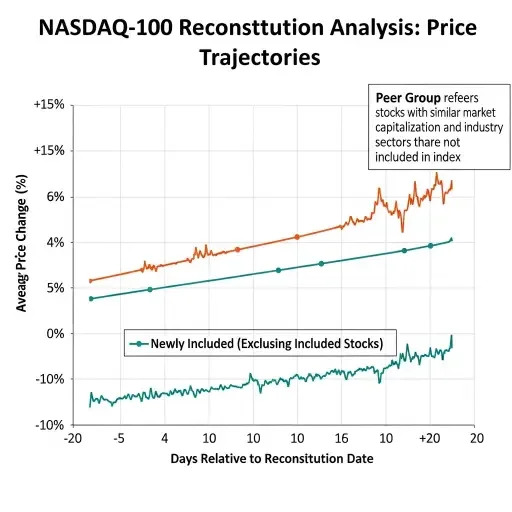

The practical effect is visible in price action. Studies of recent reconstitutions show transient but sharp price moves in newly included securities in the days surrounding announcements. Those moves often overshoot what earnings revisions or news would justify, and they partially reverse in the weeks that follow. Overshoots are not merely noise; they change optionality and capital allocation decisions—momentarily increasing valuations, altering margin calls, and nudging algorithmic strategies that gate liquidity by price momentum.

That feedback loop matters because it shifts who sets the marginal price. Traditional price discovery assumed active traders and informed institutions formed the marginal bid and offer. Today, the marginal actor during reconstitutions can be a passive fund or a retail crowd—actors whose decision rule is “match the index” or “buy the momentum” rather than “update on fundamentals.” When the marginal participant is mechanically constrained, prices can become a function of index engineering.

That raises two questions for investors and regulators. First: are index flows legitimate market signals? Yes—but conditionally. Flows aggregate preferences and capital friction; they reveal where liquidity is actually traded. They are a signal of allocation preferences. But they are weak as a measure of fundamental change when the flow is largely mechanical or attention-driven. Second: should the structures that amplify mechanical flows be altered? Possibly—but the remedy is nontrivial.

Options for mitigation fall into three buckets. One: execution design. Index providers and ETF issuers can stagger trades, use optimization windows, or permit intra-day reweighting to smooth demand. Two: product engineering. ETFs can offer crossing mechanisms or creation/redemption timing that better internalizes order flow without forcing immediate market interaction. Three: disclosure and education. Retail platforms and ETF sponsors could do more to reveal timing and impact of reconstitutions, nudging investors away from synchronized, short-horizon behavior.

None of these fixes are panaceas. Staggered execution reduces price pressure but increases tracking error and execution cost. Crossings and off-exchange settlements lower immediate market impact but concentrate counterparty risk. Better disclosure helps sophisticated investors but rarely changes impulsive retail behavior driven by attention and social signals.

For portfolio managers, the arithmetic is straightforward: anticipate mechanical demand and trade around it rather than into it. That means building reconstitution-aware execution schedules, using limit orders as shields against momentum spikes, and recognizing that post-rebalance mean reversion is a persistent, exploitable pattern. For active managers, reconstitution periods are windows to harvest liquidity and to express views when transient dislocations create relative-value opportunities.

Regulators face a subtler task. They must decide whether index-driven price pressure constitutes market fragility worth addressing. The answer sits between market neutrality and paternalism: eliminate mechanics that demonstrably harm long-term investors, but avoid penalizing the efficiencies that ETFs provide. Supervisory focus could reasonably include monitoring intraday volatility around reconstitutions, requiring clearer fee and execution reporting from ETF sponsors, and nudging market-makers toward obligations that dampen temporary dislocations.

The story of the Nasdaq-100 reconstitution is a microcosm of a larger shift: capital allocation has been democratized, but not decoupled from structural mechanics that amplify behavior. Index flows are now both thermometer and thermostat; they measure where capital is and also set the temperature. For investors, that means reading index events as hybrid signals—part preference, part plumbing—and planning accordingly.

In the end, reconstitutions will continue to matter. The question is which aspect matters most: the informational update about a company’s place in the economy, or the transient mechanics of matching an index weight. Savvy investors will treat both as inputs—not mistaking temporary currents for permanent tides, nor ignoring the force those currents can exert.

Tags

Related Articles

Sources

Securities filings, ETF flow reports, exchange reconstitution rules, market structure analyses, interviews with portfolio managers and retail-trading data firms.