Senate Agriculture Committee Chairman John Boozman confirmed Sunday that markup sessions would shift to late January, citing the need for additional time to secure bipartisan backing. The postponement disrupts a timeline that crypto advocates hoped would deliver comprehensive market structure legislation before November’s midterm elections.

The delay exposes fault lines that legislative momentum had temporarily obscured. Democrats and Republicans remain divided on three core questions: how decentralized finance protocols should be treated under federal law, how to partition regulatory authority between the SEC and CFTC, and whether crypto platforms can offer incentive programs that function economically like yield.

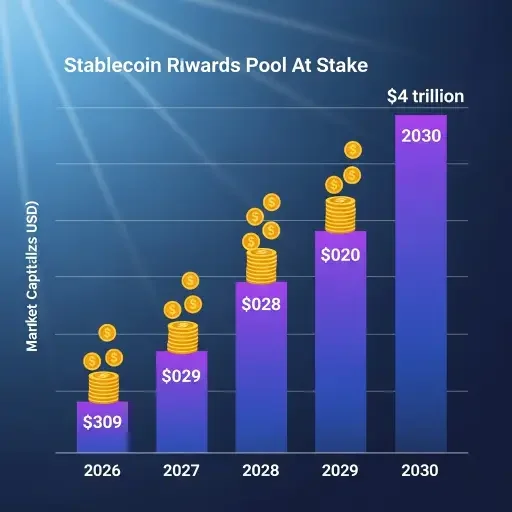

That third question carries immediate financial consequences. Stablecoin supply currently sits near $309 billion. Bernstein projects growth to $420 billion by year-end, with Citi forecasting $1.9 trillion in a base case and $4 trillion in a bull case by 2030. A platform offering 1.5 percent to 2.5 percent rewards on current supply would distribute $4.6 billion to $7.7 billion annually. At Bernstein’s 2026 forecast, that pool reaches $6.3 billion to $10.5 billion.

Banks argue this creates unfair competition. The American Bankers Association and 52 state banking associations urged Congress to clarify that the GENIUS Act prohibition should extend to partners and affiliates of stablecoin issuers. Their concern is structural: if platforms route rewards one layer removed from the issuer, the yield ban becomes theater while deposit competition happens through a loophole.

Crypto platforms counter that Congress deliberately distinguished between issuer-paid yield and platform rewards. Coinbase signaled it may reconsider support for CLARITY if restrictive language on rewards makes it into the final text, a warning that the industry’s unified front has limits.

The postponement also affects parallel developments in stablecoin infrastructure. Wyoming launched FRNT—the Frontier Stable Token—this week, marking the first state-backed stablecoin issued for public use. Franklin Templeton manages reserves backing the token, which launched on Solana and six Ethereum-compatible chains including Arbitrum, Base, and Polygon.

FRNT differs from private stablecoins by directing interest earned on reserves to Wyoming’s School Foundation Program rather than issuer profits. The structure raises questions about whether state-issued tokens can offer yield without triggering GENIUS Act restrictions—Wyoming legislators argued in July that the state’s sovereign status creates a separation from federal prohibition.

Market structure also advanced elsewhere. The FDIC proposed licensing rules for banks seeking to issue stablecoins through subsidiaries, implementing provisions from the GENIUS Act ahead of the law’s January 2027 effective date. World Liberty Financial, affiliated with the Trump family, applied for an OCC national trust bank charter to issue its USD1 stablecoin and improve conversion efficiency for customers.

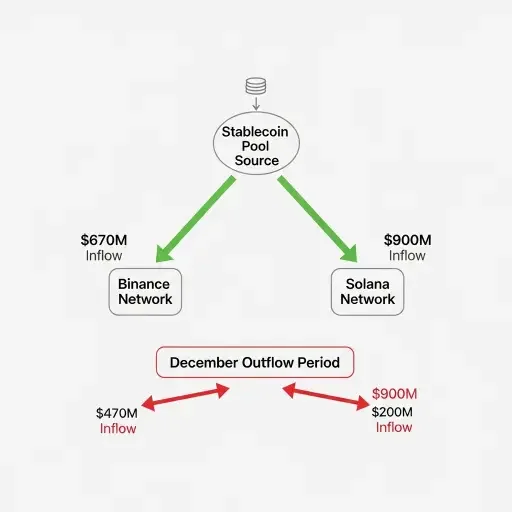

Liquidity is returning to crypto markets after December’s contraction. Binance recorded more than $670 million in net stablecoin inflows during the first week of January, reversing November and December outflows that totaled $7.5 billion. Solana’s on-chain stablecoin supply grew by $900 million in the same period, driven partly by Jupiter’s stablecoin launch and Morgan Stanley’s filing for a Solana-focused exchange-traded product.

Stablecoin transaction volumes reached $33 trillion in 2025, up 72 percent from the prior year, according to Artemis Analytics. Circle’s USDC accounted for $18.3 trillion while Tether’s USDT recorded $13.3 trillion. The growth reflects expanding use cases beyond trading—payment fintechs including Stripe, PayPal, and Western Union are building settlement rails around stablecoins for cross-border and business-to-business payments.

DeFi total value locked approached $176 billion in late 2025 and is projected to exceed $200 billion in early 2026, representing a fourfold expansion from the $50 billion trough following FTX’s November 2022 collapse. Ethereum controls approximately 68 percent of DeFi activity, though institutional participation is spreading across lending, borrowing, and stablecoin settlement protocols.

The regulatory framework for DeFi remains among the most contested aspects of the CLARITY Act. Proponents argue decentralized protocols offer efficiency and transparency while challenging legacy financial systems. Skeptics within regulatory agencies and traditional finance warn that code-driven models complicate investor protection and market integrity standards. The DeFi Education Fund is lobbying to ensure developers aren’t held liable when their technology is misused for illicit finance.

Senator Angela Alsobrooks proposed compromise language allowing exchanges to pay rewards on transactions made with stablecoins while barring programs that pay rewards on tokens sitting idle in wallets. The distinction attempts to separate payment-related incentives from deposit-like products that would compete directly with bank savings accounts.

The legislative calendar creates additional pressure. If the Senate Banking Committee and Agriculture Committee cannot reconcile their respective drafts and advance a unified bill, floor consideration could slip past the pre-midterm window that industry advocates view as essential. Election-year politics and potential government funding deadlines further compress the available timeline.

Chairman Tim Scott stated that talks with Democrats had made progress before the postponement, and several industry participants expressed cautious optimism about eventual passage. But the decision to delay signals that consensus remains fragile. The committees need more than agreement on broad principles—they need line-by-line text that both parties can support through floor debate and a 60-vote threshold.

Market participants are recalibrating expectations. The industry built its regulatory advocacy coalition around the premise that clear rules enable innovation. The CLARITY Act will test whether that coalition survives the specifics of what those rules actually say, particularly on questions that directly affect business models and competitive positioning.

Wyoming’s FRNT launch demonstrates that stablecoin development is proceeding regardless of federal legislative outcomes. State-level innovation, institutional partnerships, and expanding transaction volumes create facts on the ground that federal regulation will need to accommodate. Whether Congress can convert years of negotiation into enforceable law before political cycles shift remains the central question for the week ahead and the months that follow.

Related Articles

Sources

Research drawn from Bank Policy Institute legislative updates, Bloomberg reporting on stablecoin transaction volumes, American Banker coverage of payment fintech developments, CryptoSlate analysis of CLARITY Act amendments, Senate committee notices and statements, Wyoming Stable Token Commission announcements, and market data from Artemis Analytics and crypto exchanges tracking January liquidity flows.