BTIG’s upgrade of Annaly Capital Management is small in words and large in incentive. The research house elevated Annaly on a simple but potent claim: the firm’s dividend coverage and book-value resilience are stronger than the market currently discounts. For an asset class whose appeal rests on predictable cash distributions, that affirmation changes the calculus of yield hunting. Allocators who had written off subordinated tranches—preferred shares, junior notes, and control-premium convertible paper—may now find those securities offer a cleaner path to income as core common equity rerates.

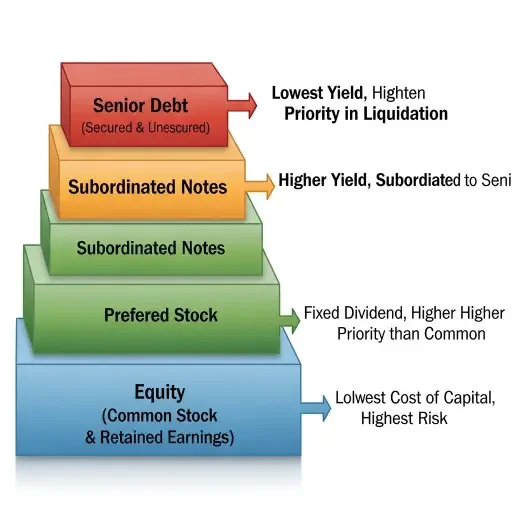

Why this matters: mortgage REITs are not one instrument but a capital-stack topology. Common equity absorbs price volatility first; preferreds and subordinated notes carry contractual coupons and sit between equity and senior secured obligations. When a reputable broker upgrades a large common like Annaly, two immediate vectors close toward yield instruments. First, some allocators rotate out of common equity into higher-coupon subordinated paper to lock income while accepting less price upside. Second, the endorsement reduces perceived tail risk for the issuer, shrinking the credit spread premium demanded for junior claims. Both mechanisms exert upward pressure on subordinated prices.

The mechanics are straightforward and measurable. Annaly’s recent quarterly reporting showed core net interest income steady and a tangible book-value cushion after provisioning—metrics BTIG cited in upgrading the name. Market-implied default risk for agency-backed mortgage REITs remains low; the principal exposures are spread and financing-cost dynamics, not headline credit events. For holders of preferreds and subordinated notes, that matters because recovery assumptions under stress models are more favorable when asset value deterioration is limited.

The current pricing landscape reflects a risk-reward misalignment. Many subordinated securities still trade at spread levels that imply higher credit stress than fundamentals warrant. Take preferred shares: a tranche paying a 7–9% coupon might trade at a 15–20% discount to par, yielding effectively in the double digits. That yield embeds not only coupon but a liquidity and idiosyncratic access premium. When an upgrade compresses the headline equity risk premium, the spread on these discounted instruments narrows in response—either through price appreciation or a re-pricing of forward expected returns.

This is not an unconditional endorsement to load up on junk-rated paper. Two constraints temper the opportunity. One, duration exposure: subordinated preferreds can have long effective durations, and a shock to interest rates would hurt total returns even if credit holds. Two, structural covenants and call features: many preferreds are callable, meaning gains may be capped if issuers redeem at par when refinancing becomes cheap. For investors whose mandate is yield rather than total-return alpha, those constraints are manageable; for total-return mandates, they require careful modeling.

The trade is therefore a relative-value play inside a sector where capital reallocations happen quickly. Consider flow mechanics: a sizeable institutionalallocator reducing common-equity exposure needs deployment targets. Subordinated instruments are natural recipients because they preserve issuer exposure while offering higher current income. Passive vehicles—ETFs and closed-end funds—amplify these movements. As flows accelerate, price discovery shortens, and the spread compression that began with an analyst upgrade becomes self-reinforcing.

Where to be selective: not all subordinated instruments will participate equally. Prioritize securities with three features:

- issuer-level balance-sheet transparency and frequent reporting;

- floating-rate or reset coupon structures that shorten duration tail risk; and

- favorable call protection or long non-call periods.

Annaly, by virtue of size and disclosure cadence, checks the first box; its suite of preferreds and notes includes several floating or reset instruments that mitigate outright rate exposure. Smaller issuers or those with opaque hedging strategies will not benefit equally from a flow-driven rerating and may lag or even widen.

Risk management must remain explicit. Position sizing should assume partial compression—an analyst upgrade rarely eliminates the full risk premium priced into subordinated securities. Use hedges: buy-duration short positions to offset interest-rate risk or use credit-default swaps on sector indices rather than issuer-specific contracts to manage idiosyncratic event risk. Monitor liquidity: preferreds can be thin, and bid-offer spreads often widen during stress, complicating exit strategies.

The near-term view is pragmatic. BTIG’s upgrade is a catalyst that can compress spreads and lift subordinated valuations, but it does not alter secular exposures: financing costs, spread volatility, and regulatory capital conventions still govern mREIT economics. What changes is relative attractiveness. For yield-first allocators seeking coupon plus modest downside protection, subordinated REIT instruments now present an asymmetric, short-duration-of-risk pathway to income—provided investors are selective and hedge the macro risks.

Compression across subordinated tranches would also have feedback effects on the broader structured-finance complex. If mortgage REIT preferreds rally, fixed-income allocators may reallocate from corporate high yield toward securitized credit wrappers that offer a similar yield with different convexity. That rotation would tighten funding markets for REITs, lowering overall borrowing costs and, in a cycle, improving the profitability of net interest spreads—an indirect boon for the original equity rock on which the upgrade was premised.

In practical terms: treat BTIG’s upgrade as a signal, not a guarantee. Model scenarios where spreads compress 50–150 basis points across preferreds; stress-test for a rate shock that removes half the compression; size exposures so that a 20–30% adverse move remains within mandate tolerances. For the patient yield hunter, the upgrade creates an entry window that is both tactical and defensible.

Tags

Related Articles

Sources

BTIG research note, recent Annaly earnings and dividend data, sector bond/preferred pricing from market close, public filings.