A pragmatic consensus is forming in U.S. policy circles to create a limited, enforceable corridor for crypto and AI development—one that trades absolute freedom for predictable rules, coordinated standards with allies, and tax clarity intended to keep capital and talent domestic.

Every revolution in capital or code eventually meets a regulator. The recent hum in Washington is not panic; it’s a design conversation. Inside policy rooms where aides, economists, and industry lawyers circulate drafts, the emerging posture is surgical: build regulatory certainty that preserves U.S. competitive advantage while constraining the most systemic risks of both crypto and AI.

Why now: two converging pressures. First, capital and talent are mobile in ways they weren’t a decade ago—developers move across jurisdictions; funds chase tax and regulatory arbitrage. Second, both technologies have matured into infrastructure: crypto protocols underpin tokenized finance and settlement rails; AI models are now core inputs to enterprise productivity and platform control. That combination turns regulatory ambiguity into a strategic loss: if the U.S. is uncertain, capital migrates to certainty abroad.

The state’s binding constraint. If the question is “who can force everyone to adapt,” the answer today is plainly the state. Congress, the SEC, Treasury, and interagency working groups are the axis. Their formulation of rules—what counts as a security, how data governance treats model outputs, and how transactions are taxed—will reconfigure who can raise money, where platforms host compute, and which technical architectures are investible.

Three policy vectors are currently under quiet negotiation.

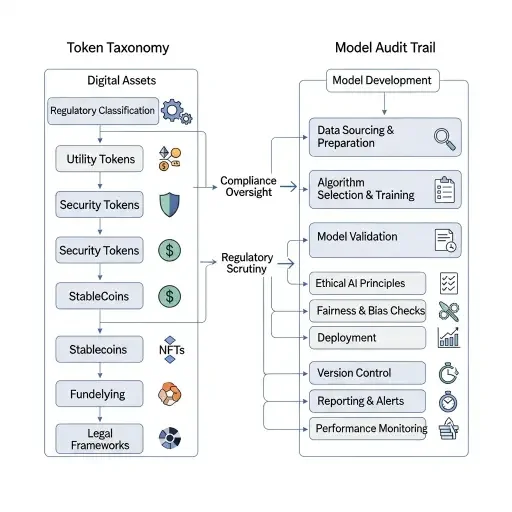

- Legal classification and standards. Expect clearer definitions rather than open-ended doctrines. For crypto this means a workable taxonomy: tokens that serve as payment, utility, or investment will have distinct compliance pathways. For AI it means standardized audit trails for model provenance and performance, and industry-accepted benchmarks for harms and robustness. The practical upshot is that projects able to instrument and certify compliance—onchain attestations for crypto, immutable model logs for AI—gain a de facto moat.

-

Cross-border cooperation on standards and taxation. The U.S. prefers rules that others can mirror: interoperable tax treatments for token transactions, mutual recognition of regulatory labels, and joint standards for data handling and model certification. That cooperation reduces arbitrage. For investors, the salient point is predictability of after-tax returns and operational compliance costs across major markets.

-

Enforceability and market supervision. Policymakers are focused on making rules that can be audited and enforced with existing tools—reporting obligations, licensure for certain platforms, and liability for systemic failure. This shrinks the set of viable business models to those that bake observability into their stack: auditable contracts, verifiable compute logs, and custodial practices aligned with regulatory expectations.

These vectors are not a carte blanche. The proposed corridor will be conditional—regulated permission, not permissionless license. Firms that can prove auditable compliance and show systemic safeguards will receive market access; those that cannot will face restrictions or be priced out by compliance costs.

Winners will be incumbents and well‑capitalized entrants that can afford compliance engineering: exchanges that retrofit custody; cloud providers that offer certified “compliant compute” for model training; token projects that adopt standard attestations. Losers include marginal, highly leveraged protocols, opaque token issuers, and AI startups that prioritize rapid, uninstrumented iteration over audited development practices.

Investor principle: assume a compliance premia. In this environment, allocate not merely on product-market fit but on observability and compliance cost curves. Ask whether a business can integrate auditable controls without destroying its unit economics. If not, price that into valuation or pass.

A final hazard: regulatory capture by incumbent platforms. The state’s power is necessary for certainty—but it can be leveraged by capital to entrench winners. Cross-border cooperation helps: when standards are multilateral and tax regimes interoperable, it’s harder for a single jurisdiction’s incumbents to game the rules. Still, vigilance in rule design—mandating interoperability, preventing exclusive certification pathways, and preserving competition—is crucial.

Washington is sketching a narrow regulatory window for crypto and AI—structured rules, enforceable standards, and tax clarity intended to keep ecosystems onshore. This is not deregulation; it is an engineered corridor for growth. For investors and builders the operating principle is simple: build for observability. Firms that embed auditable controls and can demonstrate compliant behavior will buy themselves market access; those that cannot will pay a premium in capital costs or exit.

Re-evaluate product roadmaps with “auditability” as a first-order feature. Model pipelines, token contracts, and custody mechanisms should be measurable, attestable, and resilient to legal interpretation. That posture turns regulatory certainty from a threat into a competitive advantage—and that will be the signal the market trades on next.

Tags

Related Articles

Sources

Congressional hearings and policy proposals; SEC, CFTC, and Treasury regulatory statements; crypto and AI industry association briefings; policy analysis from Brookings, AEI, and other think tanks; international regulatory coordination documents.