Every market shock has two stories: the one the headlines sell and the quieter arithmetic investors will actually live with. Over the last quarter, chatter about aggressive Medicaid reforms and pricing pressure put Gilead Sciences (GILD) on watch lists. The more careful read — numbers first, policy second — shows that Medicaid risk is real but contained; Biktarvy, Gilead’s single-tablet HIV regimen, remains the firm’s principal revenue engine and arrives with only modest price exposure. That combination turns a headline crisis into a manageable earnings sensitivity.

Medicaid is noisy; the binding constraint for investors is reimbursement math, not press cycles. Recent policy proposals sought to expand Medicaid’s negotiating leverage and narrow allowable price increases. But they have either been diluted, delayed or structured in ways that limit retroactive clawbacks — the corporate risk that would most meaningfully hit near-term cash flows. Gilead’s exposure, therefore, looks more like increased friction in future price setting than a sudden demand collapse.

For investors this distinction is crucial. A retroactive rebate or clawback forces immediate revenue restatements and cash surprises. Narrower, forward-looking price caps merely change long-run gross-to-net dynamics, which are easier to model and hedge. Put succinctly: the timing and shape of policy execution matter more than the headline.

How that translates to Gilead’s P&L depends on three variables: (1) the share of Biktarvy sales in Medicaid populations, (2) the delta between current net prices and any new Medicaid-negotiated rates, and (3) contractual timeframes for adjustment. Gilead’s HIV franchise skews toward commercially insured and Medicare patients; Medicaid share is material but not dominant. Historical gross-to-net buffers — rebates, voluntary discounts, and contract provisions — already absorb a fair amount of pricing variance.

Analysts who stress-test Gilead with extreme Medicaid scenarios often assume uniform price markdowns across lines. That’s an improbably blunt instrument. States negotiate differently; formularies and preferred status still buy market share. Biktarvy’s clinical simplicity — single-pill dosing, high barrier to resistance, and strong tolerability — gives it an advantage on formularies that blunt substitution risk. The immediate takeaway is not that Gilead is immune; it is that the company’s commercial mix and contractual architecture make a headline-driven Medicaid shock unlikely to produce catastrophic earnings surprises.

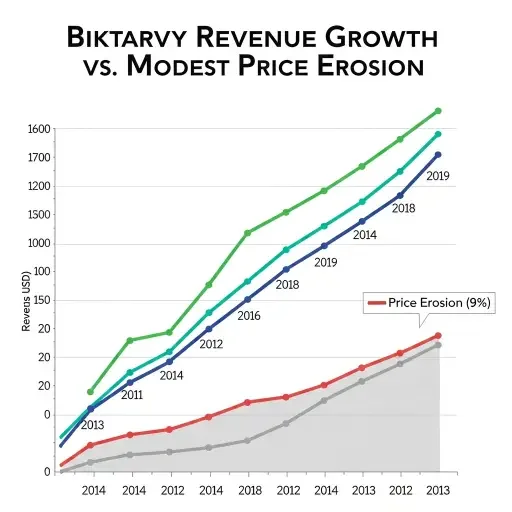

Biktarvy’s mechanics are straightforward: it’s the largest contributor to Gilead’s HIV revenue and has been a primary driver of top-line growth. In the last four quarters, Biktarvy growth has outpaced most antiretroviral competitors, driven by new patient starts and market share gains from older regimens. Those volume gains substantially offset modest unit-price erosion in many payor channels. Importantly, the drug’s patent and exclusivity profile keeps a full generic substitution risk at bay for now.

Where investors worry is not volume but price. But Biktarvy’s price exposure is muted by a mix of long-term contracting, patient assistance programs, and a payer preference structure favoring single-tablet regimens. These factors create a “stickiness” to net realized prices: list price can be aspirational, but the net price trajectory is smoother and slower to fall.

Market-share retention also matters. When a drug is clinically superior and easier for patients to adhere to, switching costs are clinical and administrative, not merely financial. That raises the hurdle for payors to force patients onto cheaper but less-adherent regimens. In short, volume is likely to be less elastic than a simple price shock model would assume. Financially, moderate price compression combined with stable-to-growing volume keeps Biktarvy in the “core steady driver” bucket — a predictable cash-flow contributor rather than a high-volatility revenue swing.

What does this mean for Gilead’s valuation multiple and downside risk? If Medicaid policy produces incremental net price pressure, goodwill for the company’s valuation will be measured in basis points of EBITDA margin, not percentage-point catastrophes. Capital markets will reprice risk, but absent broader industry-wide retroactive cuts, the company’s free cash flow profile should remain serviceable for share-repurchase programs and R&D funding.

That said, investors should watch three variables closely: (1) concrete legislative changes that permit retroactive rebates, (2) state-level formulary shifts that disfavor single-tablet regimens, and (3) any early generic entrants that meaningfully undercut net pricing. Each is a low-probability but high-impact event. In practice, the most probable path is incremental margin compression with preserved revenue growth from HIV. The balance sheet and capital allocation choices Gilead makes in response — buybacks vs. reinvestment — will determine realized equity returns more than the headline Medicaid noise.

Read the policy; watch the execution; model the reimbursement. Gilead faces regulatory headwinds, but the company’s commercial architecture and Biktarvy’s clinical and contractual resilience convert a potential pricing scare into a quantifiable sensitivity. For investors, the prudent posture is not panic but calibrated hedge — adjust multiple assumptions modestly, stress-test for retroactivity, and keep Biktarvy-centered scenarios as the base case.

Gilead’s Medicaid exposure is contained; Biktarvy remains the engine. Headlines are gusts; clinical advantage and contracts are ballast. Let policy breadth inform probability, not dictate position sizing.

Tags

Related Articles

Sources

Gilead Sciences earnings reports and guidance; Medicaid pricing policy documents and CMS announcements; pharmaceutical industry analysis from Bloomberg, STAT News, and industry research firms; HIV treatment market data.