American Signature’s bankruptcy signals a larger rattle in the home-goods sector. This article threads the data points—credit conditions, discretionary appetite, inventory velocity, and retailer solvency—to offer a disciplined forecast for investors and managers alike. The takeaway: until consumer spending stabilizes, the home-furnishings market remains a high-variance space, where one bankruptcy can presage a cascade of supply-chain recalibrations and liquidity stress.

The macro frame is unambiguous: consumer balance sheets have endured a battering from inflation and rising interest costs. Household debt service has crept higher, even as wages regain a whisper of health. The home goods category—traditionally buoyant on sentiment about home improvement and renovations—now sits at the intersection of cost-consciousness and credit restraint. American Signature’s filing is not merely a corporate event; it’s a pressure point that reveals the sector’s fragility beneath the surface.

inflation rate from 2020–2025.

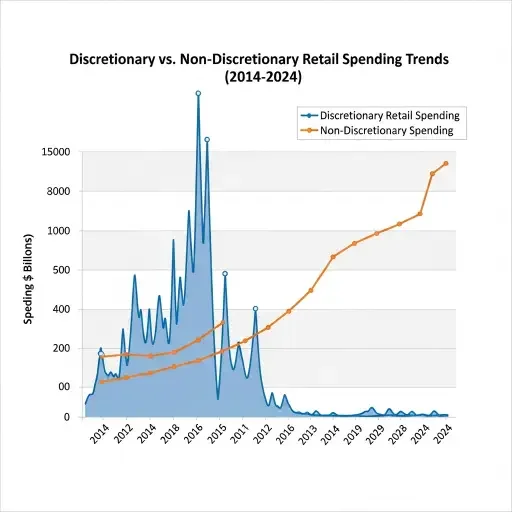

Why, precisely, does a single bankruptcy matter for the broader sector? Because furniture is almost uniquely sensitive to two levers: disposable income and financing terms. When shoppers face tighter credit or higher hurdle rates, big-ticket purchases retreat first. In the current cycle, the mortgage and auto sectors still scream, but the home-goods aisle cools earlier and more decisively. This creates a chilling effect on manufacturers and distributors who rely on turnover velocity and floor-space occupancy to manage margins. A distressed retailer increases discounting, shifts channel mix toward non-store sales, and compresses wholesale opportunities as inventory sits longer.

Analytically, you can read American Signature’s move as a stress test for the category’s demand elasticity. If demand is inelastic to price shifts, retailers can maintain sales volumes through promos. If demand is elastic—as the data now suggest—the franchise must absorb discount-driven top-line pressure, degrade capital structure, and attempt turnaround through cost reductions and restructured debt. The bankruptcy suggests the latter: relief will be iterative, not transformational, and attention will pivot quickly to other similar chains with exposure to the same macro-dynamics.

From a portfolio perspective, the signal-to-noise ratio tilts toward caution. Even as the economy avoids full-on recession, consumer sentiment has become a weak motor. Elevating rates, persistent inflation, and uncertain wage trajectories compress the consumer’s “luxury per dollar” calculus—home upgrades are often the first casualties. For investors, the message is not to abandon the space entirely, but to stage risk by segment: premium brands with durable demand cycles may weather a soft spell; generic, commodity-driven home-goods players likely face compressed margins and elevated rollover risk.

To understand the timing, compare with historical episodes in furniture retail. The category’s cyclicality is real, amplified by inventory dynamics: manufacturers run leaner when demand signals weaken; retailers pull forward markdown calendars; wholesalers renegotiate terms; and credit channels tighten for consumer-end purchases. The American Signature event is a real-time data point—one piece of a mosaic that, if read in aggregate, points to a longer consolidation phase for home goods distributors and a slower path to re-acceleration.

How should executives and managers respond? At the micro level, lenders will scrutinize liquidity buffers, debt maturities, and covenant safety valves. At the product level, category managers should realign assortments toward higher-velocity items, reduce capital-intensive SKUs, and optimize inventory turns with tighter demand forecasting. At the macro level, the sector benefits from transparency: early disclosure of distress signals can prevent surprise cascades and stabilize credit markets.

From a narrative-vantage point, American Signature’s bankruptcy is a waking lesson in the economics of postponed gratification. When households delay purchases of big-ticket items, the entire finger of the supply chain slows. The stock prices of adjacent players temper their gains; the cost of capital for other retailers stiffens; and consumer expectations recenter toward value, durability, and function over fashion.

What, then, should observers watch next? Look for three indicators: (1) inventory age and discount cadence across mid-market home-furnishings chains; (2) consumer-credit conditions as reflected in store-backed financing and promotional financing terms; and (3) the cadence of store closures or restructurings in the broader sector. If all three tilt toward conservatism, the sector’s recovery will require external tailwinds: wage growth, housing demand revival, or a sharper easing of inflation to lower the cost of capital.

The larger narrative is paradoxical: distress in one retailer reveals a system-wide sensitivity. The American Signature chapter underscores a structural truth about home goods economies in inflationary regimes: demand is more brittle than it appears, and supply-chain velocity magnifies the consequences of that brittleness. The prudent reader should translate this into a cautious stance: position portfolios for selective exposure, diversify away from timing-sensitive buyers, and align corporate strategies with a stabilized consumer horizon rather than a return to peak pre-2020 optimism.

Endnote: The balance between repetition and revelation remains essential. In this piece, redundancy is not noise but signal reinforcement—repeated prompts that anchor the reader’s mental model while integrating new data. The bankruptcy is a compact data point within a broader, messy truth: retail’s health now tracks the consumer’s willingness to spend on comfort, not just necessity. As with any complex system, order emerges from disciplined, purposeful design—and the next set of earnings calls will reveal how much of this design the sector can sustain.

Tags

Related Articles

Sources

Public filings, retail earnings commentary, supply chain analyses, consumer sentiment polls, historical bankruptcy precedents in furniture retail