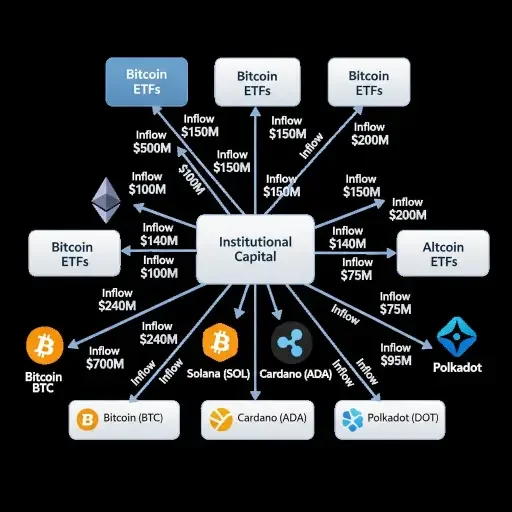

Hedge funds expect spot ETF approvals; reduced regulatory risk premium; flows concentrate in BTC and select altcoins; consequences for liquidity, skew, and allocation frameworks.

Every large allocation is a bet on the probability distribution of future rules and flows. For much of this cycle, hedge funds priced crypto with an extra “regulatory haircut”—a risk premium that reflected the chance of adverse enforcement, product bans, or protracted approval delays. That haircut is shrinking. Recent signals from regulators, clarified custody and surveillance standards, and a spate of structured-product filings have combined to compress the regulatory risk premium to levels many macro and quant managers deem investable.

Why does an ETF approval matter to hedge funds? Three mechanisms, each with measurable portfolio consequences.

-

Flow Amplification: Spot ETFs create on-ramps for long-duration capital—pension, endowment, and retail—via familiar wrappers. Those flows are mechanically sizable: even conservative adoption trajectories imply billions in passive and semi-passive demand for BTC alone. For hedge funds, that external demand reduces the cost of establishing large directional positions and narrows bid-ask spreads, lowering transaction costs for both long and short strategies.

-

Market Structure Normalization: An ETF-centered market anchors custody, settlement, and surveillance norms. That normalcy lowers operational counterparty risk and makes prime brokers and custodians more willing to offer leverage and credit lines against crypto exposures. Practically: managers can scale position sizes without paying punitive financing terms.

-

Asset Selection Compression: With macro liquidity likely to prefer highly liquid instruments, capital will disproportionately accrue to BTC and a small set of altcoins that meet liquidity, on-chain composability, and regulatory hygiene tests. Hedge funds will reweight portfolios accordingly—more concentrated bets in fewer names, and an emphasis on basis trades, arbitrage between ETFs and spot markets, and lending/borrowing strategies rather than dispersion across hundreds of tokens.

How funds will act depends on strategy archetype.

-

Macro/CTA: These managers see ETFs as a cleaner beta vehicle. Expect CTA allocations to treat spot-BTC ETFs as a liquid risk asset with explicit volatility and correlation schedules. Position sizing will be governed by volatility targeting models rather than idiosyncratic custody fears.

-

Quant/Market-Making: Tightened spreads and deeper order books invite larger inventory and tighter quoting. Quants will monetize basis and cross-exchange frictions—ETF creation/redemption arbitrage, custodian latency, and differences in lending rates between spot and ETF shares.

-

Event/Relative-Value Funds: They will hunt for mispricings born of structural transitions—ETF launch effects, window-dressing at quarter ends, and changes in liquidity provision. These funds also carry tail hedges: regulatory gamma is lower, but not zero; legal or jurisdictional shocks still create skew.

What determines winners and losers? Three practical filters that allocators and managers are already using.

-

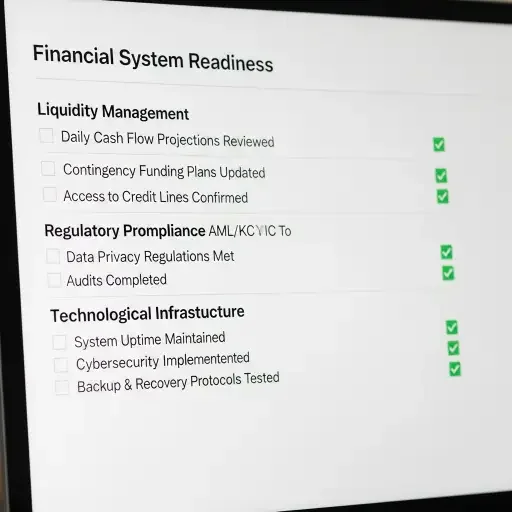

Liquidity Filter: Market cap, turnover, and depth at the tightest times of day. Tokens that fail this filter are unlikely to attract durable ETF-linked flows.

-

Compliance Filter: Clear provenance of code, transparent governance, and a defensible KYC/AML posture. Assets with opaque issuance or concentrated tokenomics risk premium will be screened out.

-

Infrastructure Filter: Custody readiness (insurtech, multisig standards), available on/off ramps, and interoperability with capital markets plumbing. If a token cannot be custody-ready in a compliant way, it will not see ETF-mediated flows.

Risks remain—and they are asymmetric. Regulatory clarity so far is directional, not absolute. A sudden pivot in policy, a high-profile fraud, or cross-border regulatory conflict could reintroduce a premium quickly. Second, concentration risk: if most flows compress into BTC and a tiny cohort of altcoins, correlation can spike during stress, undermining hedges predicated on diversification. Finally, product execution risk—ETF design details (creation/redemption mechanics, authorized participants, and settlement cycles) matter for how cheaply and quickly flows translate into spot liquidity.

For allocators and hedge funds the actionable principle is simple: model the new baseline but stress the tails. Operationally, this means (1) re-evaluating financing terms with prime brokers, (2) stress-testing concentrated BTC/altcoin exposures under liquidity shocks, and (3) building trading playbooks that exploit ETF-specific arbitrage while preserving capital to manage episodic dislocations.

The compression of the regulatory risk premium doesn’t equal regulatory certainty, but it changes the calculus. Capital follows clarity. When clarity rises, so does the attractiveness of scaled, ETF-mediated exposure—especially for bitcoin and the handful of altcoins that can pass liquidity, compliance, and infrastructure filters. Hedge funds are not merely chasing a new ticker; they are rewiring allocation frameworks to exploit a lower-cost path for institutional demand. That structural change, not short-term price action, is the story that will matter to investors who decide where to put large sums of money next.

Tags

Related Articles

Sources

SEC crypto ETF approval announcements and regulatory guidance; hedge fund industry reports and allocation data; cryptocurrency market analysis from CoinDesk, The Block, and Bloomberg; institutional investment research.