In the pale, gleaming hour between a stablecoin’s aura and sovereign insecurity, Tether has chosen to tilt its chessboard toward gold. The company—long known for its U.S. dollar-pegged stablecoins and a market capitalization flirting with half a trillion dollars—has begun acquiring stakes in gold royalty companies Elemental Altus and EMX Royalty. The aim: a modern Fort Knox, a physical and financial backbone that can absorb fiat shocks while maintaining liquidity in a turbulent macro environment. It’s a move that makes old-world security feel 21st-century chic: tangible gold, digital dollars, and the quiet certainty of perpetual hedging.

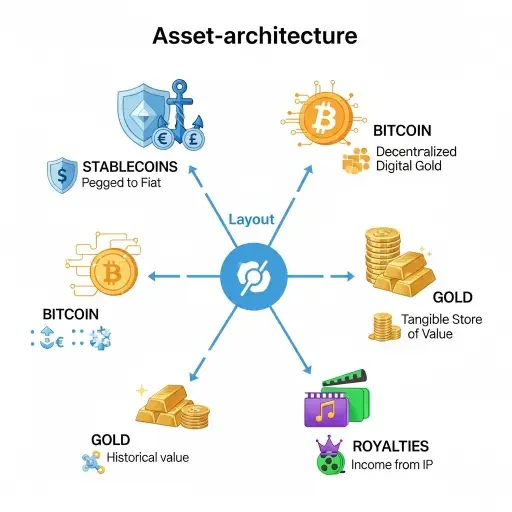

The logic is not merely diversification. It is architecture. Tether’s leadership appears to be constructing a dual-anchor system: one anchored in Bitcoin, one anchored in physical gold royalties. Bitcoin, in the mind of many of its boosters, is the digital equivalent of portable liquidity—a hard cap on supply with a growing institutional embrace. Physical gold, meanwhile, remains the most visible hedge against fiat debasement and policy misfires. By tying together these elements through gold royalties, Tether seeks to convert a liquidity-rich balance sheet into a stability engine that can weather macro shocks and policy reversals.

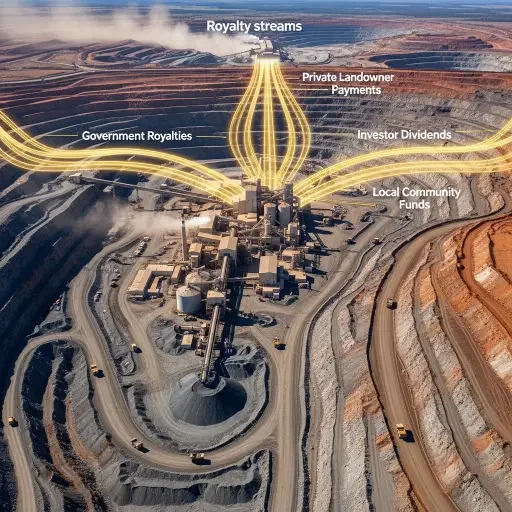

Specifically, the firm has carved stakes in Elemental Altus as a pathway to access royalty streams generated by gold projects. Elemental Altus, with its suite of precious metal assets and mining royalties, promises recurring income tied to production rather than to volatile spot prices alone. The model resembles a royalty-structured annuity: cash flows continue to accrue regardless of short-term price fluctuations, dampening revenue volatility. It’s a financial instrument that—when scaled—could offer Tether a predictable yield overlay to support its vast stablecoin ecosystem.

EMX Royalty enters as a complementary piece: a diversified royalty and streaming company whose portfolio spans precious metals across multiple jurisdictions. The EMX exposure is not simply about holding a stake; it’s about embedding a stream of miners’ royalties into a balance sheet that must also service billions in Bitcoin exposure, custodial arrangements, and fiat-mobility risk. The strategy readouts resemble a corporate version of hedging: if fiat debasement accelerates, the royalties’ revenue streams and the gold price provide a counterweight. If Bitcoin strengthens, the crypto leg of the equation gains resilience from a broader, asset-backed foundation.

The optics matter here. Tether’s leadership has long balanced PR narratives about enabling open finance with a cautious sobriety about risk. In a world where governments talk of digital currencies, sanctions risks, and regulatory scrutiny intensifies, a visible commitment to gold and royalties signals a stabilizing posture. It is a story of hedges and dual-systems—where Bitcoin’s programmable liquidity sits alongside a physical, auditable gold base. The objective is not to abandon risk—but to reframe it as managed exposure, distributed across a layered architecture that can be explained in plain terms to skeptics and believers alike.

gold price stability.

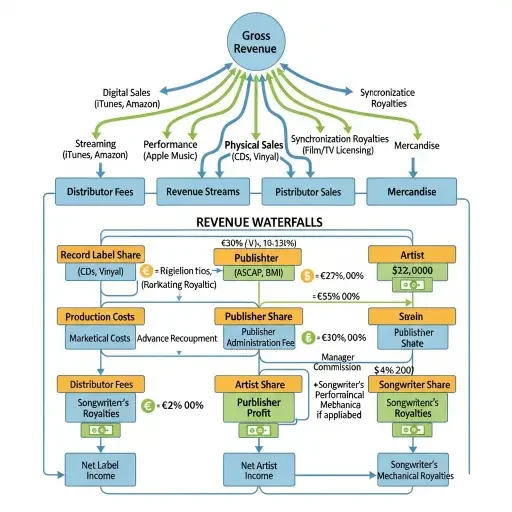

The financial consequences are more nuanced than headline risk. For a firm already managing trillions of dollars in convertible power—tokens that promise dollar-pegged stability—the royalties serve as a long-tail income engine. They provide a cushion against sudden liquidity squeezes and a potential revenue stream that does not depend on a single asset’s performance. In practice, this means the company can sustain operational scale, weather regulatory storms, and still maintain a sense of silver-blooded calm in their investor communications.

Yet questions linger. What is the cadence of these acquisitions? How much of Elemental Altus and EMX Royalty does Tether own, and what are the governance implications for the royalties’ production decisions? Could the move toward physical gold royalties be misread as a retreat from the digital, or is it a calculated harmonization of two distinct forms of value storage? Critics will wonder whether such a strategy risks embedding a centralizing force in an ecosystem that has thrived on liquidity and permissionless innovation. Proponents will argue that stability, properly layered, does not stifle innovation; it stabilizes it enough to scale.

A broader arc emerges: if crypto markets want legitimacy beyond the speculative arc, they will need anchors that endure through cycles. Tether’s gold-royalty architecture can be read as a test case—an institutional bet on the proposition that a hybridized store of value, with both digital and physical legs, offers superior resilience to fiat devaluation. It’s not a panacea, but it is a narrative that invites scrutiny, not dismissal. The future of asset allocation in crypto-inflected economies may be less a single asset class and more a spectrum—from digital tokens to royalty-backed streams to the gold bars gleaming behind a vault door.

At the edge of this conversation sits a stark question about sovereignty and trust. If the fiat system weakens, who holds the keys? Tether’s strategy suggests an answer: multiple keys, a diversified vault, and a governance framework that can explain itself in quarterly disclosures and independent audits. The modern Fort Knox, in this telling, is not a single vault but a cluster—gold royalties embedded in corporate structures, Bitcoin as a digital anchor, and a stablecoin ecosystem that benefits from both.

Endgame: the recursive stability loop in a volatile economy. Tether’s gold land grab is less a retreat into gold alone than a rearchitecting of risk—an adaptive, information-engineered structure designed to minimize cognitive load for investors navigating fiat chaos. If it succeeds, it will be read not as an aggressive deviation from crypto norms but as a disciplined, transparent attempt to align incentives across assets, markets, and time.

What to watch next: regulatory disclosures, the cadence of governance rights within Elemental Altus and EMX Royalty, and the performance of royalty streams across macro cycles. As fiat policies wobble and digital assets age into maturity, Tether’s Fort Knox experiment will still be in progress—an ongoing test of whether a hybrid, entropy-optimized architecture can deliver durable stability for a world built on both blockchain promises and human trust.

Tags

Related Articles

Sources

Industry reports on Elemental Altus and EMX Royalty, Tether financial disclosures, crypto market analyses, and gold royalty sector commentary.