The Immediate Fracture: Political Stalemate Meets Market Instability

Every shutdown is a signal disruption—a break in the state’s informational coherence. Payrolls halt, reports stop, data vanish. Investors, deprived of guidance, reach for proxies.

Crypto became one.

As the U.S. Treasury’s spending engine idled, markets sought liquidity elsewhere. The Federal government’s frozen disbursements subtracted billions from daily circulation, compressing money velocity. Bitcoin and Ethereum, once insulated by narrative, suddenly reflected the same contraction: prices fell by double digits in a week. Traders described it as “a vacuum event”—not panic, but informational starvation. Without new fiscal data, markets reverted to reflex: sell, wait, watch.

Specifically, Bitcoin dropped below $100,000 in early November. Ethereum fell near $3,200. XRP, Ripple’s bridge currency for institutional settlement, slid almost 20%. It was not a crypto crisis; it was an echo of a larger systemic pause.

In this sense, crypto acted less like rebellion and more like a mirror—its algorithms mapping the nervous system of a state deprived of signal.

The first effect of the shutdown was informational: uncertainty propagated across markets through missing data and halted liquidity, translating directly into volatility.

The Macro Linkage: Liquidity, Trust, and the Dollar’s Shadow

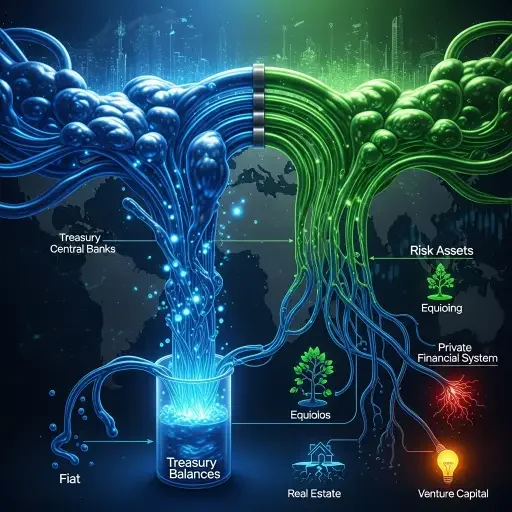

Liquidity is the bloodstream of both fiat and crypto economies. During the shutdown, Treasury balances ballooned while spending collapsed. Cash left the private system; risk assets starved.

For traditional markets, this meant higher yields and lower equities. For crypto, it meant something subtler: a loss of narrative liquidity. The story that digital assets were “outside” the system dissolved. Traders realized crypto’s price still rides on global liquidity conditions—tighten the hose, and the pressure drops everywhere.

The paradox deepened when the Senate signaled a funding breakthrough. Bitcoin rebounded above $106,000; Ethereum re-crossed $3,600. Nothing had changed in crypto’s internal logic. What changed was the macro thermostat: risk tolerance returned. The blockchain was still immutable; human psychology was not.

The shutdown made visible what theory long denied: crypto may be decentralized in architecture, but it remains centralized in sentiment—anchored to the fiscal and psychological stability of the U.S. government.

Regulatory Paralysis: When the Watchers Sleep

The shutdown’s bureaucratic freeze also silenced the regulatory apparatus—an underreported, high-impact consequence. The SEC and CFTC, operating on emergency staffing, paused nonessential functions: ETF approvals, enforcement actions, and clarifications on digital-asset classifications.

To traders, this meant a temporary ceasefire. To institutions, it meant delay. Several spot Bitcoin ETF applications, due for decision in late October, rolled into an indefinite queue. The result: uncertainty re-entered the system through policy latency.

This created a strange duality. Retail traders saw freedom; institutional desks saw fog. Price discovery stalled. In information-theoretic terms, the entropy of the system increased—not from noise, but from silence.

A functioning regulator reduces uncertainty by defining boundaries. When government pauses, those boundaries blur, and markets become their own auditors.

Behavioral Feedback: The Psychology of a Shutdown Market

Markets are cognitive systems. When institutions lose confidence in the predictability of fiscal governance, they seek non-state alternatives. Crypto’s late-October rebound, brief as it was, stemmed not from optimism but defiance—the rediscovery of digital assets as self-custodial refuges.

Yet this reflex has limits. Empirical data show correlation spikes between Bitcoin and the NASDAQ during crises. In practice, crypto does not exit the system; it synchronizes with its stress patterns. The narrative of “digital gold” resurfaces each cycle, but its duration shortens. Each rally becomes a smaller refuge.

This behavioral loop—fear, migration, mimicry—illustrates crypto’s current paradox: it is simultaneously an alternative to, and a derivative of, the state it critiques.

The psychological interplay between government stability and digital autonomy defines crypto’s volatility more than technology itself does.

The Reopening Wave: Information Returns to Flow

When the Senate passed its funding bill on November 10, data flow resumed. Economic reports restarted, Treasury operations normalized, and the private sector exhaled. Crypto responded within hours. Market liquidity improved as confidence rebounded.

But analysts cautioned: the rally’s foundation was political, not structural. The continuing resolution extends funding only through January 2026. Crypto markets, forward-looking by nature, priced in both relief and relapse. The next budget standoff is already a latent variable in the charts.

Still, this episode leaves a trace: the correlation coefficient between Bitcoin and 10-year Treasury yields peaked at 0.82 during the shutdown—a record alignment. Information, once decentralized, had converged again on Washington.

The end of the shutdown restores motion but not independence; crypto remains entangled with the fiscal rhythms of the state.

The Structural Insight: Crypto as an Informational Mirror of Governance

Beyond price and policy lies a deeper symmetry. The U.S. government shutdown and the crypto market both revolve around one substrate: trust as information flow.

In governance, trust is procedural continuity—the assurance that salaries, data, and decisions persist tomorrow. In crypto, trust is mathematical continuity—the assurance that code executes without permission. Both systems fail when continuity breaks: one through politics, the other through speculation.

Viewed through this lens, the 2025 shutdown was a live experiment in information theory. When institutional signals froze, decentralized networks oscillated. The volatility was not randomness; it was adaptation—the system searching for equilibrium in the absence of central narrative control.

The shutdown was a laboratory in macro-entropy: state silence increased global uncertainty, and crypto translated that uncertainty into price amplitude.

Future Implications: Toward a Dual-System Economy

If the past month offers a preview, future shutdowns will increasingly ripple through crypto as an auxiliary nervous system of fiscal confidence. Traders will monitor Capitol Hill the way earlier generations watched the Fed. Meanwhile, governments—aware that crypto sentiment now feeds back into consumer behavior—may begin to treat digital asset markets as unofficial barometers of trust.

Regulatory architecture will adapt. Stablecoins, already bridging Treasury yields and blockchain liquidity, could evolve into real-time instruments of fiscal sentiment—instant indicators of how the digital public values U.S. governance.

The distinction between “state money” and “crypto money” will blur not by ideology but by shared dependency on informational coherence.

The next frontier of economic design lies not in separation but in synchronization—aligning centralized policy with decentralized feedback loops.

Conclusion: The Recursive Signal

The 2025 shutdown revealed that digital and political economies are not opposites; they are coupled oscillators. When one falters, the other vibrates. Crypto, far from existing outside government, now functions as its shadow telemetry—tracking, amplifying, and sometimes pre-empting public confidence.

To understand crypto’s future, watch not its code but its correlations—the informational bandwidth between the algorithmic and the administrative. Where that signal converges, the next monetary order will begin.

Sources

Based on recent Bloomberg, CoinDesk, and Reuters coverage of the November 2025 U.S. government shutdown and concurrent crypto market data.