TheraVectys, the Paris-founded immunotherapy company, is weighing a listing in Hong Kong—an explicit bid for Asia’s deeper growth capital and a strategic hedge against crowded Western markets. For a European biotech with clinical-stage assets, the calculus is straightforward: broader pools of patient capital, a different investor mentality around biotech growth risk, and proximity to potential commercial partners in Asia.

The immediate appeal of Hong Kong is twofold. First, the exchange now tolerates more biotech risk than it did a decade ago—regulatory reforms, larger biotech funds domiciled in Asia, and a pipeline of successful cross‑border listings have lowered the perceived liquidity premium. Second, Asian institutional investors and family offices are deploying larger checks into late‑stage therapeutics, attracted by the asymmetric returns of high-growth drug developers. For companies that need capital to complete Phase II/III trials or to scale manufacturing and commercialization, access to that depth matters.

Asia’s appetite has structural origins. Demographics and market growth create a long-term demand for new therapies; more immediately, Asia’s capital markets have been engineered to absorb equity stories at scale. Hong Kong’s market microstructure—concentrated blocks of long-term capital, active sovereign and quasi-sovereign funds, and robust retail participation—changes the shape of an IPO outcome compared with a Lisbon, Paris, or small-cap U.S. listing.

For Theravectys, the move would not be merely financial theater. A Hong Kong listing could function as a signal to Asian strategic partners—pharma firms, hospital chains, and contract manufacturers—that the company is serious about regional commercialization. That signal has pragmatic consequences: faster licensing discussions, easier negotiation of co-development deals tailored to Asian patient populations, and a staged rollout strategy where local reimbursement dynamics are engaged early.

But the path is not frictionless. Cross-border listings bring governance, regulatory, and cultural frictions: financial reporting must align with Hong Kong Stock Exchange (HKEX) standards; investor relations must penetrate an investor base with different due diligence norms; and corporate governance practices are often interrogated more intensely by media and analysts attuned to regional political sensitivities. For a non-Chinese biotech, managing those frictions requires both legal scaffolding and narrative discipline.

Institutional investors see two practical tests. One, can the company translate its clinical story into a commercial roadmap that resonates with Asian payers and regulators? Two, is the ownership structure and board composition credible for a market that prizes local ties? Successful precedents—non-Chinese biotechs that listed in Hong Kong and later secured Asia-wide licensing deals—offer a playbook: combine transparent governance, local advisory seats, and early-stage regional partnerships before listing.

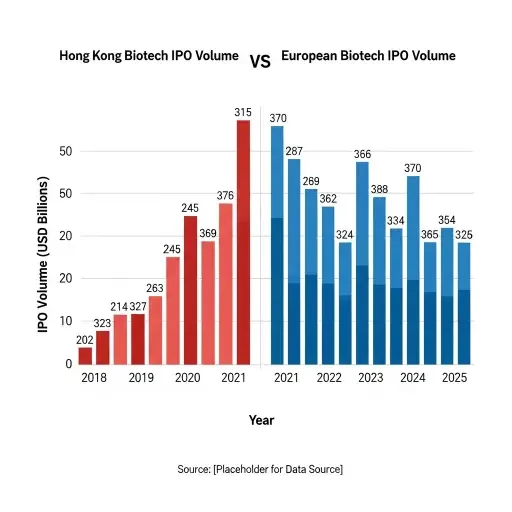

The capital calculus is also comparative. European public markets, particularly small-cap healthcare venues, remain shallow and sometimes hostile to binary-risk profiles of clinical-stage therapeutics. The U.S. market can offer higher valuation ceilings but is crowded and expensive; listing there often competes directly with well-funded domestic peers and concessional IPO windows. Hong Kong provides a hybrid alternative: valuations can be generous for differentiated assets, and the investor base will often value near-term commercialization paths in Asia more highly than Western counterparts.

TheraVectys’ consideration joins a growing list of international biotechs viewing Hong Kong not as a secondary market but as a strategic front. The trend reflects a maturation of Asia’s life‑sciences financing architecture: specialized biotech funds, secondary markets for follow-on financings, and a deeper pool of crossover investors who can carry a company from IPO through pivotal readouts. That maturation shifts the opportunity set for companies whose growth depends on large, patient capital commitments.

Yet this shift also reweights risks. Political and policy tail risks—geopolitical tensions and export controls—create execution uncertainty for cross-border biotech strategies. Currency considerations, differing intellectual property regimes, and potential scrutiny over clinical data provenance add complexity. For boards and CFOs, the decision to list in Hong Kong will hinge on whether the incremental capital and strategic partnerships justify the operational and reputational adjustments required.

A pragmatic playbook for Theravectys would include three elements. First, pre-IPO engagement: secure at least one anchor investor from the region—either a dedicated healthcare fund or a strategic life‑sciences corporate—that can validate the thesis. Second, governance adaptation: appoint regional advisors or non-executive directors with established Asia market credentials to bridge cultural and regulatory expectations. Third, commercial scaffolding: demonstrate early patient access programs or regulatory dialogue that shows Asia is not an advertising campaign but a real market strategy.

The broader lesson for non‑Chinese biotechs is structural: capital is no longer geographically fixed. Exchanges have evolved and investors have diversified; what once was an exotic listing destination is now an accessible capital channel with its own standards and advantages. Choosing where to list is thus an exercise in matching capital characteristics to clinical and commercialization timelines—an optimization problem where the objective function includes not just price, but partnership, market access, and execution speed.

TheraVectys’ deliberation is consequential because it tests that optimization in practice. If carried through, a successful Hong Kong IPO would add empirical weight to a thesis that Asia’s financing architecture can be a primary growth engine for international biotechs. If it falters, it will remind European and U.S. boards that cross-border finance still requires careful choreography.

In either outcome, the episode underscores a simple shift: biotech capital strategies are increasingly global, and capital-location decisions now sit alongside R&D portfolios as strategic levers. For executives deciding where to seek patient capital, Hong Kong has moved from curiosity to credible option—and Theravectys appears poised to help write the playbook.

Tags

Related Articles

Sources

Reporting based on market disclosures, financial filing precedents, IPO market activity in Hong Kong, and interviews with biotech capital markets advisors.