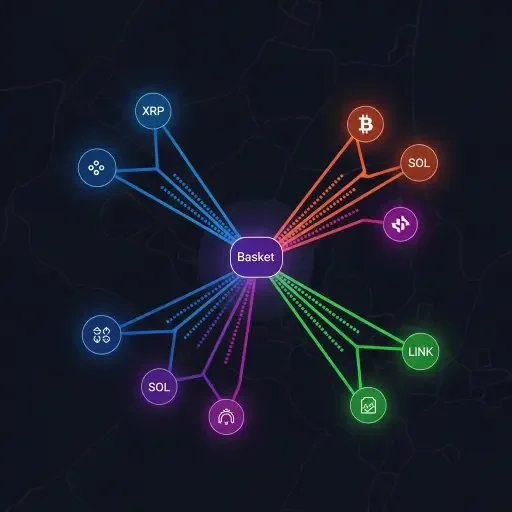

The idea of an exchange-traded fund is to compress uncertainty into a single, tradeable instrument. In crypto, a family of new altcoin ETFs seeks to do this not with broad indices of every token but with curated baskets—XRP, SOL, LINK, and companions—that promise to offer liquidity, transparency, and rebalanced risk budgets. This article dissects what that portends for allocation theory, portfolio construction, and the psychology of trust in highly volatile markets. It treats the ETF as a cognitive amplifier: it does not remove risk, but it can reorganize how risk is perceived, priced, and absorbed.

The first hinge is the construction logic. Traditional crypto investing often comes down to single-asset bets, sector bets (layer-1 vs. smart contracts, for example), or macro bet-sizing. Altcoin ETFs flip the script by packaging a set of assets into a single vehicle, then applying a governance and rebalancing rule set. The core proposition is not merely convenience; it is a curated risk budget. If the basket emphasizes XRP’s liquidity symmetry, SOL’s programmable throughput, and LINK’s oracle role, the index becomes a statement about how a diversified crypto allocation should look in a regime of rising regulatory expectations and episodic liquidity stress.

individual token allocations across a 3-year horizon, with risk-adjusted returns highlighted.

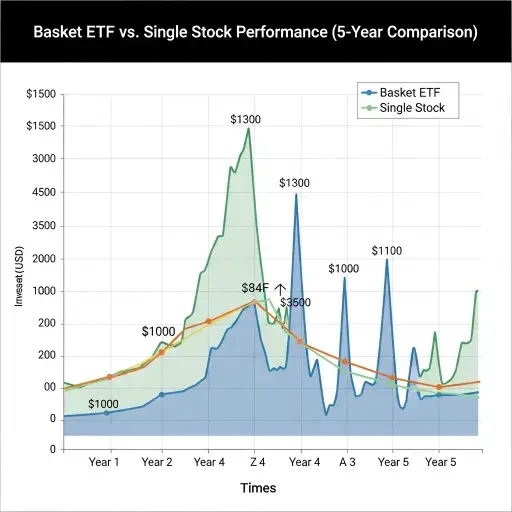

From a risk-management perspective, the basket approach borrows heavily from traditional asset allocation: diversification, correlation management, and rebalancing discipline. But crypto adds fevered correlation dynamics—intermittent contagion from market-wide shocks, and idiosyncratic bursts around network upgrades or regulatory rulings. A basket ETF can dampen idiosyncratic shocks by reducing the weight of any one token when it dislocates; yet it could amplify systemic moves if the basket itself becomes a signal in crowded trades. For institutions, the value proposition hinges on governance: transparent methodology, trackable liquidity, and a credible overhang of counterparties.

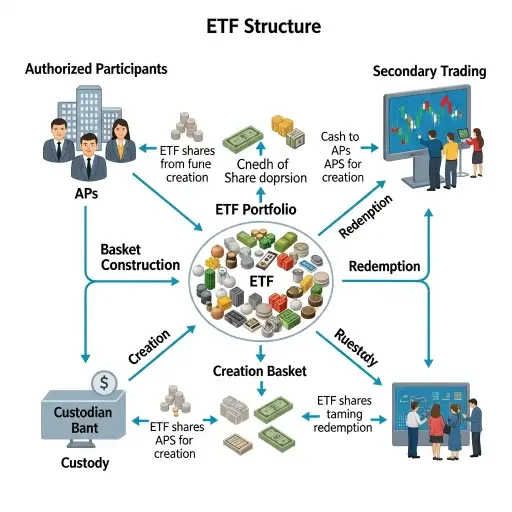

The second major hinge concerns market structure and execution. ETFs offer centralized pricing, tighter spreads, and the possibility of intraday liquidity via parent market making. They also port in custody, settlement, and compliance rails that separate the investor from the token’s on-chain operational fragilities. For crypto, where custody debates are ongoing and where some tokens feature non-trivial staking or lending constraints, a basket ETF can reduce operational friction. The price discovery still hinges on the underlying basket’s performance, but the ETF wrapper translates that performance into a familiar, regulated reliability layer. The cost is an opaque layer of management fees and potential premium/discount dynamics that arise in ETF markets—especially during periods of convective volatility.

A subtle, but critical, behavioral effect emerges: the “basket bet” creates a semantic anchor for buyers who want exposure without leaning into a single-token thesis. The market’s almond-shaped memory—remembering last week’s XRP rally or this month’s SOL upgrade—begins to harmonize around the basket rather than episodic token narratives. For investors, this means more disciplined rebalancing, especially when cross-asset correlations spike. It also invites a reconsideration of risk budgets: if the ETF’s volatility profile resembles a mid-cap equity sleeve rather than a volatile single token, then oversight dashboards, stress tests, and governance checks can be calibrated accordingly.

Of course, the question remains: does a basket ETF truly alter the allocation frontier, or does it simply rebrand it? The entropy-aware answer is nuanced. If the basket’s composition remains relatively stable and the rebalancing cadence is transparent, it changes nothing essential about the long-run risk-reward calculus. It does, however, shift the cognitive load: decision-makers can operate with a structured, legible framework that borrows the efficiency of traditional portfolios while preserving crypto’s dynamic edge. In practice, that means more consistent exposure to XRP’s liquidity scaffolding, SOL’s modular platform, and LINK’s oracle-enhanced data reliability—without needing to assemble and constant-check a multi-token thesis.

Yet caution remains. The entropy design requires strict transparency about methodology, sector weightings, and rebalancing triggers. Without that, the ETF could morph into a liquidity channel for speculative herding, diluting meaningful risk signals. The prudent path blends governance with liquidity engineering: pre-announced rebalance windows, clearly defined horizon risk metrics, and explicit disclosures about counterparty exposures.

In the longer arc, altcoin ETFs could enable new capital pathways for crypto projects that previously depended on bespoke private placements or bespoke derivative structures. They offer an inviolable constraint: a well-defined risk budget that translates across investors and markets. If designed with rigorous cognitive ergonomics—predictable cadence, explicit transitions, and accompanying visual aids—the ETF becomes a transparent extension of a diversified crypto sleeve rather than a speculative accelerant.

Conclusion: as the crypto market matures, structurally sound, entropy-aware instruments may become the scaffolding that supports broader adoption. By packaging XRP, SOL, LINK, and related assets into disciplined baskets, altcoin ETFs could rewire allocation logic—reducing cognitive load, clarifying risk, and broadening access—without erasing the uncertainty that makes crypto exciting.

Notes for readers who crave the numbers: watch for basket composition disclosures, rebalancing cadence, liquidity metrics (average daily trading volume and share of underlying token liquidity), and custody counterparties. These are the levers that determine whether the ETF stabilizes or simply compartmentalizes volatility.

Sources

Regulatory filings on altcoin ETF proposals, issuer whitepapers, liquidity analyses, historical correlations, and market commentary from crypto researchers.