The market’s favorite kind of news is not a blaring headline but a shifted calculus: a credible, durable improvement that recalibrates bets across a chain. When Canadian National (CNI) moved from coverage-neutral to Outperform, the quiet structural readjustment began. It wasn’t a splashy earnings beat or a dramatic fleet expansion; it was a recalibration of throughput economics, a reweighing of marginal cost against marginal value, and, crucially, a translation of efficiency into survivability for a class of small-cap logistics players that usually live on the margins of Wall Street chatter.

What does an upgrade to Outperform imply for the network that runs on steel and schedules? It signals a higher probability that CNI will squeeze more volume per route, reduce dwell times at hubs, and push service reliability into the green. The downstream reverberation is not just more revenue; it’s a more predictable engine of cash flow for every node that touches the rails: the wagon suppliers who tailor empties and fulls for traffic bands; the brake-system vendors who maintain cadence on heavy-tonnage legs; and the railcar lessors who supply the rolling stock that moves when demand seizes its moment.

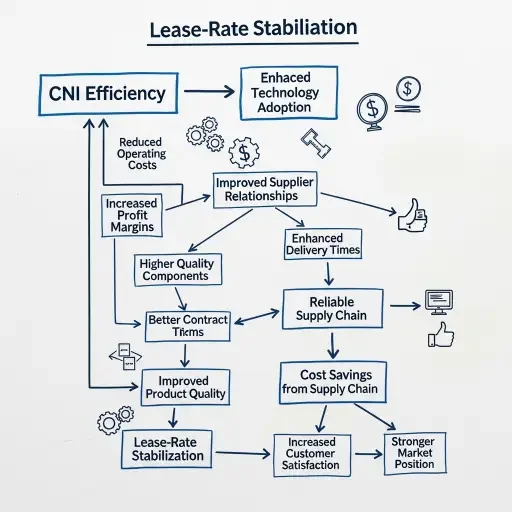

In this environment, the most interesting opportunities live in the “before-the-railcar-gets-itself-on-the-tracks” layer: the suppliers and the lessors who have structured themselves to capture incremental throughput at the margins. The growth thesis rests on four pillars:

Throughput discipline as a competitive moat

CNI’s optimization is not purely about longer trains or more cars; it’s about predictable dwell times, faster turnarounds, and tighter schedule adherence. Those improvements compress cycle times for everything that touches the system. Suppliers who provide components that reduce maintenance downtime or extend fleet life benefit from a higher utilization curve. Railcar lessors with modern, modular fleets that can be reconfigured quickly to demand pockets gain pricing power in a tightening capacity environment.Ancillary equipment as a lever

Brake systems, couplers, wheels, bearings, and maintenance services—these are the quiet engines behind the headline throughput gains. When an operator attains higher reliability, buyers in the value chain—industrial shippers and regional freight haulers—are emboldened to push for better service, which ripples into more robust maintenance demand and longer-term leases on newer equipment. The winning suppliers are those who align product lifecycles with the cadence of the asset’s utilization, not merely its purchase price.Leasing structures attuned to volatility

Railcar lessors that blend long-duration leases with flexible options capture more of the upside when utilization spikes. The upgrade to Outperform increases the probability that freight demand grows in a manner that sustains elevated lease rates. In other words, the lessor who built a balance sheet capable of weathering cyclicality now stands to monetize volume in both the short and medium terms.Capital allocation discipline in the supply chain

Investors should parse not just the op-ex savings, but the capex implications of a higher-utilization regime. Companies that can finance modern fleets through favorable debt terms—while layering maintenance efficiencies—stand to compound value faster than those who chase incremental volume with aging gear.

From a price-sensitivity perspective, a few micro-truths matter:

- The small-cap suppliers with specialized, durable components can gain margin durability even if macro freight cycles softify. Their addressable markets expand as throughput grows and service quality becomes a selling point.

- Railcar lessors with adaptable assets—units that can be bumped up to heavier tonnage, swapped to different axle configurations, or re-shimmed for fuel efficiency—tend to outperform in times of transportation scarcity.

- The timing of renewal windows matters. A best-in-class operator like CNI tends to synchronize maintenance cycles with lease maturities, creating nested, compounding effects on the value chain.

This is not a rallying cry about one stock; it’s a lens on how operational gains can create a synchronous uplift across a constellation of beneficiaries. The value in this setup lies in identifying the tangential players—the suppliers and lessors—that export efficiency gains into profitability. In practice, the smartest bets are those whose earnings streams exhibit resilience to short-term macro noise while staying aligned with the throughput backbone. As CNI nudges its own cadence higher, the question for investors becomes: who else gains from the turnstile?

One additional frame, to crystallize the entire argument: think of the network as a circulatory system. If the heart (CNI) beats with steadier cadence, the arteries (suppliers and lessors) carry more blood with less friction. The result is a broader macro picture: a logistics ecosystem that compounds throughput into durable cash flow, even when the economy’s pulse rates fluctuate.

In the end, the upgrade-to-Outperform signal is a map, not a destination. It signals that the mechanism of efficiency—the careful orchestration of assets, maintenance, and capital—has become the primary driver of value. For the risk-aware investor, the frontier lies with the gear that keeps the rails running: the suppliers who cut fracture risk on moving parts, and the lessors who finance the next wave of modular, high-utilization fleets. The rails don’t lie; they whisper a future where throughput is king, and the margins ride along next to it.

Sources

Company notes, rail industry reports, freight throughput data, and historical analyses of railcar leasing cycles.