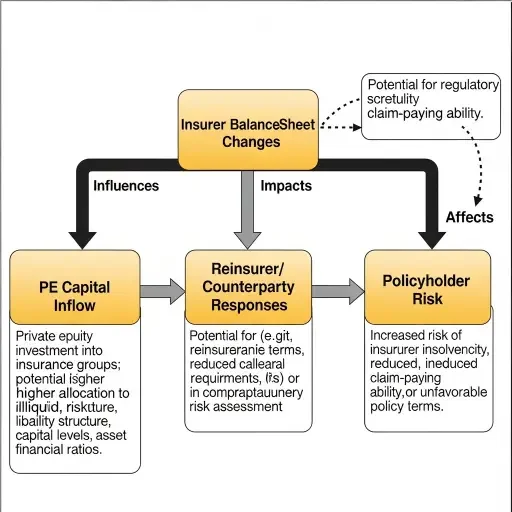

Private-equity buyouts → balance-sheet engineering → credit squeeze in specialty lines → policyholder and guaranty-fund implications. PE mechanics change capital flows, tighten credit for specialty insurers, and shift elevated tail risk to policyholders and guaranty funds.

Private equity’s arrival in specialty insurance is not decorative; it is transformative. Expansion capital, leverage, and fee extraction rewrite the economics of insurers that once sold niche coverages—professional liability, specialty cyber, trade credit, and other thin-margin lines.

PE sponsors typically pursue returns through three levers: capital structure optimization (more debt), managerial interventions (cost cuts and re-pricing), and capital-light distribution strategies (reinsurance and fronting). Those moves can improve ROE fast. They can also compress the cushion between liabilities and the credit instruments insurers rely on to smooth losses: bank lines, letters of credit, and collateralized reinsurance arrangements.

In specialty lines, which depend on nuanced underwriting and episodic loss patterns, liquidity is a function of both balance-sheet depth and counterparty trust. When a sponsor swaps equity for debt and layers fees atop premiums, two predictable effects follow: (1) the insurer’s leverage profile tightens, making creditors and reinsurers more selective; (2) counterparties demand tighter collateral terms or higher spreads, effectively shrinking available credit.

Put simply: PE restructurings can turn capital into a conditional resource—there when markets are calm, but constrained when losses trigger margin calls or rating pressure. That conditionality tightens credit for specialty insurers and pushes risk downstream to policyholders and state backstops.

The tightening mechanism is literal. Consider letters of credit (LOCs) and trust accounts: reinsurers and cedents demand collateral to pay claims. If a PE-owned insurer’s debt-to-equity spikes, its LOC pricing worsens or lenders shrink capacity. A downgraded insurer may see reinsurance credit allowed fall, generating a liquidity mismatch: claims are due; collateral is not immediately deployable. In that window, policyholders—especially commercial buyers of specialty contracts—face delayed payments, enforced premium increases, or narrower coverage.

This is not hypothetical. In recent cycles, buyers of highly specialized coverages have experienced abrupt non-renewals and premium shock when their carrier was recapitalized and reinsurers tightened terms. For brokers and corporate risk managers, the signal is simple: the market for specialty capacity becomes a function of capital-cycle arbitrage—not just underwriting skill.

A second, subtler effect is incentive distortion. Private-equity sponsors often maximize distributable cashflows early—dividends, management fees, or affiliate reinsurance revenue. That creates two correlated risks. First, underwriting may be lax in pursuit of premium growth because capital markets can absorb current-year losses; second, when loss experience turns, there may be insufficient retained capital to cover tail events. Where insurers historically ran conservative reserves and ceded less to maximize solvency, PE ownership sometimes flips the preference toward short-term cash extraction.

Regulatory consequences follow. State regulators focus on solvency and policyholder protection, not sponsor returns. But guaranty funds—the state-local safety net that pays claims when an insurer fails—are funded by assessments on surviving insurers after a failure. If PE restructurings increase failure probability across niche carriers, two things happen: assessments rise, and surviving insurers’ capacity strains, further tightening market credit. That feedback loop is classic systemic amplification: private capital compresses margins and balance-sheet liquidity, which in turn raises the expected cost of backstopping failures.

What to watch next—three operational indicators that anticipate trouble:

-

Collateral and reinsurance terms. Track shifts from letters of credit to cash collateral and frequency of collateral calls. A jump indicates counterparty risk aversion and reduced credit lines.

-

Dividend and affiliate fee schedules. Rapid increases in sponsored affiliate fees or extraordinary dividends signal capital extraction that could hollow reserves.

-

Guaranty-fund stress metrics. Monitor assessment frequency, size, and jurisdictional concentration—specialty lines clustered in certain states create local contagion risk.

Policy levers exist but are blunt. Regulators can tighten capital requirements, restrict dividend distributions, or require greater transparency around affiliate arrangements. But each tool has trade-offs: stricter capital rules raise prices or drive capacity offshore; dividend restrictions disincentivize PE investment; transparency requirements invite sponsor pushback and legal complexity.

For investors, the calculus is asymmetric. Debt and reinsurance providers who price counterparty risk conservatively can profit from wider spreads, but equity holders in these structures face higher tail risk than headline ROEs suggest. For corporate buyers of specialty insurance, the practical move is diversification: avoid concentration on single carriers with opaque ownership; demand collateralization clauses; negotiate continuity guarantees.

Private equity changes where and how risk is carried in the specialty-insurance market. It raises near-term ROEs while tightening the corridors of credit that specialty insurers depend on. When the next cluster of losses arrives, the weakest links won’t be underwriting models alone—they will be the funding agreements and contingent capital arrangements that replaced them.

Think of specialized insurers as narrow bridges. Private equity adds weight (debt and fees) to increase toll revenue; the bridge still stands in good weather. But when the flood comes, the same added weight shortens the time before a critical support gives way—leaving downstream towns (policyholders and guaranty funds) to scramble.

For practitioners—monitor collateral flows, extractions, and guaranty-fund exposure. For regulators—prioritize quick-runoff scenarios and disclosure rules that reveal where capital has been moved. For investors—price the fragility embedded in capital structures, not only the headline ROE.

PE ownership can unlock returns in specialty insurance, but it also transforms capital from a steady buffer into a conditional lever. That conditionality tightens credit, alters incentives, and raises the expected burden on policyholders and state guaranty funds. Watch collateral, dividends, and guaranty-fund signals—those three metrics compress much of the system’s future risk into measurable present-day indicators.

Tags

Related Articles

Sources

Insurance industry regulatory filings and state guaranty fund reports; private equity transaction announcements; specialty insurance market analysis from industry publications and rating agencies; policyholder protection research.