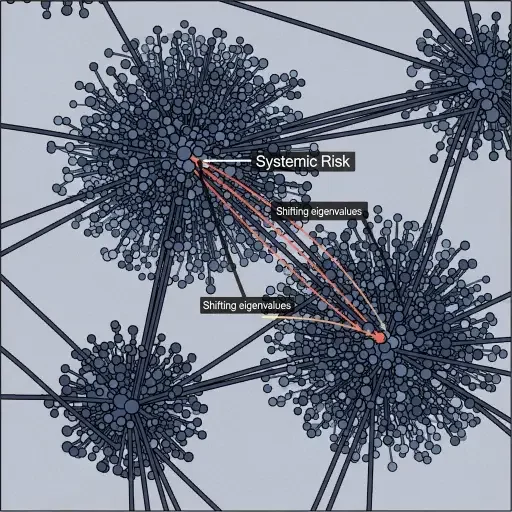

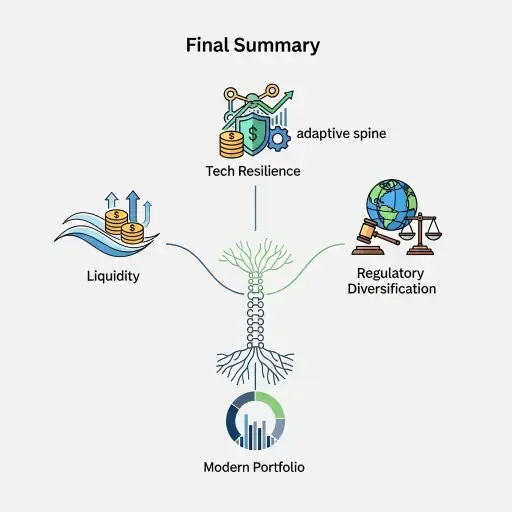

We are living inside a high‑dimensional phase transition. Political institutions, capital markets, technology stacks, and social norms have decoupled from their old correlations and are reassembling around new attractors. Economically, the system sits in metastability: AI‑fueled earnings blaze in some pockets, corporate profits hit records, crypto liquidity still hums; at the same time, private‑credit leverage, housing imbalances, and rising delinquencies tighten like a hinge. Mathematically, think networks bending toward dense hubs—Big Tech, private‑credit conduits, sovereign wealth—while edge weights deepen in opacity. The eigenvalues of the adjacency matrix have shifted, elevating systemic risk to a higher shelf. Politically, a bifurcation unfurls: populist personalization on one axis, technocratic disruption on another, driving policy into nonlinear regimes where tiny shocks reallocate trust and capital with outsized speed. Game theory follows suit: actors shift from cooperative, repeated norms to one‑shot, high‑stakes gambits, birthing spectacle diplomacy, strategic litigation, and preemptive asset protections. Socially, a generational delta opens: the young face AI‑driven unemployment risk (MIT’s ~12% replaceability figure), while elites hoard liquidity and privacy behind gilded walls of private credit. Probabilities tilt rightward: tail events—private‑credit cascades, yen carry unwind, AI‑policy shocks—carry non‑negligible mass again. Scenario planning, therefore, must ride three vectors: liquidity buffers with convex hedges; concentrated alpha in resilient infrastructure; and regulatory hedges via jurisdictional diversification. Metaphorically, we occupy both the late baroque and the first act of a cyberpunk play—ornate concentration of power paired with code rewriting the rules. The right strategy is not bravado but calibrated antifragility: position for volatility, monetize optionality, and treat narrative as a leading indicator, not a truth.

First Vector: Liquidity Buffers and Convex Hedging

The drumbeat of instability makes cash and liquid assets valuable not as hoarded certainty but as flexible ammunition. Core treasuries, selective gold exposures, and modest cash reserves become options on time and volatility. In this regime, liquidity is not a shelter but a lever: it enables rapid reweighting, enables opportunistic repositioning, and cushions the blow of mispriced risk. Think of a portfolio positioned to survive a cascade—not merely to survive but to profit from the recalibration that follows.

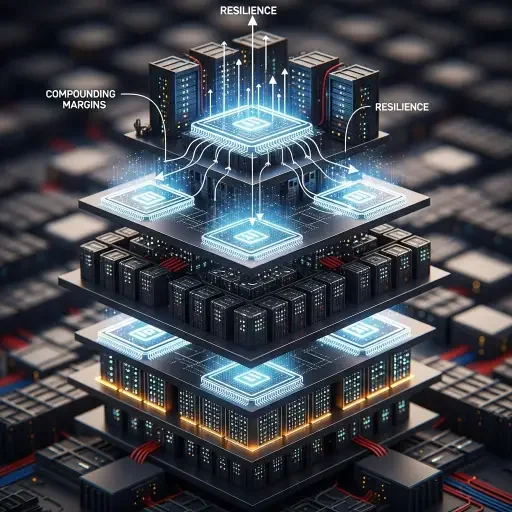

Second Vector: Concentrated Alpha in Resilient Tech Infrastructure

The future runs on compute, cloud, and data pipelines that survive shocks and tighten margins when competitors falter. AI compute pools, carrier‑grade cloud providers, and platforms with durable margin capture form the core of resilience. The logic is simple: if the system must endure more volatility, then the assets least harmed by inflating uncertainty—scale, network effects, security, and reliability—become the alpha vectors. Invest where technology multiplies optionality, not where it merely spreads risk.

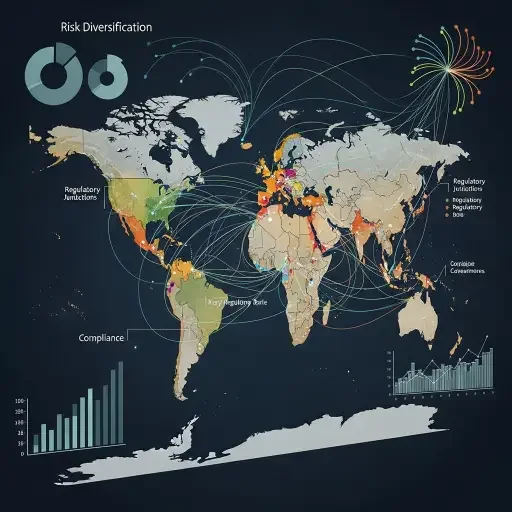

Third Vector: Political and Regulatory Hedging via Diversification

Policy risk—the unpredictable dance between rhetoric and rule—now travels through multiple jurisdictions. Diversifying regulatory exposure reduces single‑point failure. It means instinctively pairing compliant governance with strategic latitude, rotating licenses, and mapping legal risk to where the work gets done. The aim is not peacetime obedience but wartime adaptability: a capital ecosystem that can shift to friendlier jurisdictions, faster adjudications, and clearer rules without surrendering core ambition. Narrative matters here: regulation is a shared infrastructure, and hedging is no longer optional but mandatory.

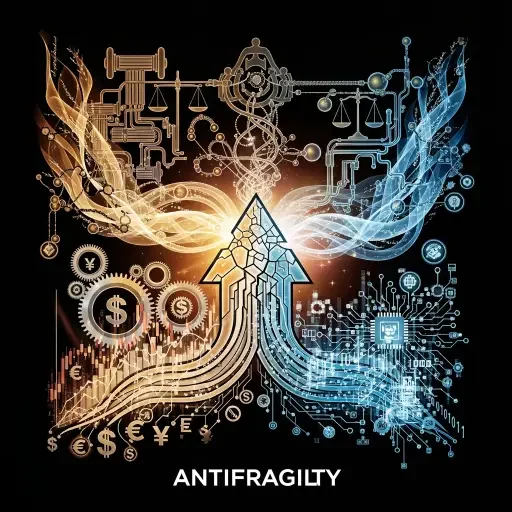

Narrative Architecture: The Baroque Meets the Code

Metastability is not a bug; it’s an architecture. The late‑baroque flourish—ornate concentration of power, ritualized spectacle, dispersion of symbolic capital—meets the cyberpunk rewrite of the rules: code as law, markets as programmable ecosystems, policy as an emergent interface. In this synthesis, success favors those who learn to read the narrative as a predictive signal, not as a comforting fable. The prudent investor/ policymaker treats risk as a spectrum with heavy tails, not a single distribution.

Yet the most actionable posture is antifragility: position for volatility, monetize optionality, and let narrative serve as a leading indicator. When the story itself becomes a data stream—regulatory whispers, corporate theatrics, political stress tests—you harvest information as you absorb it. In other words, the right strategy converts uncertainty into leverage.

Conclusion: A Three‑Part Imperative

Build liquidity rails that are convex rather than static. Cash flow and optionality enable adaptive exposure as regimes shift.

Target resilient tech ecosystems where scale and reliability translate into durable margins and faster reallocation of capital.

Diversify regulatory and jurisdictional footprints, treating policy as part of the strategic risk framework rather than a backdrop.

In a world where edges grow heavy and clusters tighten, the path forward is not bravado but calibrated antifragility. We hedge, we shift, we listen to the narrative as a predictive instrument. And we invest less in the illusion of control than in the capacity to adapt when the system reconfigures itself—skillfully, humanely, and with a sense of style worthy of Culled Collections.

Sources

A blend of MIT research on automation, central bank communications, private-credit market data, and geopolitical risk assessments.