The Outage as Market Catalyst

The outage landed like a blunt instrument on a city already steeped in dialogue about who pays for reliability and how quickly infrastructure can pivot from risk to resilience. When the lights flickered and went dark across swaths of San Francisco, what followed was not just a curtailment of commerce and comfort, but a rapid, high-stakes test of the reliability narrative that has long populated energy markets. In the hours that followed, investors scanned for signals—who owns the resilience asset, who bears the price of lagging infrastructure, and which variables will become the next quarterly catalysts.

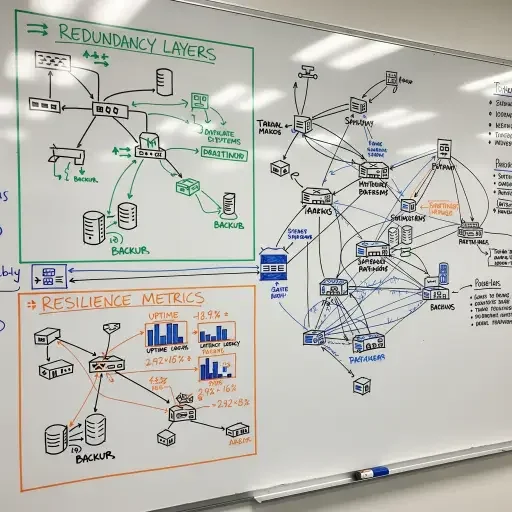

System Stress and Market Opportunity

From the first official briefings, the outage was framed as a system stress test rather than a singular failure. A handful of substations, aged transmission links, and a weather-influenced demand spike converged into a geography-wide disruption that rippled outward—from retail corridors to hospital backstays, from data centers to ferrying routes. The narrative, once abstract, sharpened into a marketable property: resilience as a strategic capability, not a charitable add-on.

The city’s utility executives spoke in the crisp cadence of risk managers and product people: to reduce future uncertainty, you must quantify it, price it, and create incentives that align system upgrades with predictable returns. It is a language that sits oddly well with the venture-capital cadence that now underpins much of grid modernization—microgrids, battery fleets, demand-response platforms, and utility-scale storage projects. The outage didn’t just reveal gaps; it revealed a grease of opportunity—the levers that can monetize reliability: uptime credits, resilience adders, and risk-adjusted pricing for capacity reserves.

Market Response and Resilience Pricing

The market’s response has been both practical and aspirational. In practical terms, operators have proposed enhanced fuel shedding schemes, more granular SCADA analytics, and autonomous switching sequences to isolate faults before cascading. In aspirational terms, the event catalyzed renewed calls for performance-based regulation that rewards demonstrable reliability improvements rather than merely maintaining compliance. If the policy frame lags, markets, buoyed by data and investor risk appetites, will fill the gap—pricing resilience into the cost of doing business in high-demand urban nodes.

Yet the outage also exposed equity questions that sit at the core of modern energy discourse. Lower-income households, small businesses, and critical care facilities faced disproportionate exposure to service interruptions. The repair cadence is not just a technical proposition; it’s a social contract: resilience must be inclusive, not exclusive. The conversation now travels beyond the plant floor to the kitchen table, where a family wonders whether a blackout this time will deprive them of heat, refrigeration, or a dialysis session. Investors sense this as a market signal, not a moral test, and they calibrate their bets accordingly: resilience yields predictable, patterns-based returns when defined by clear standards and transparent accountability.

Technology and Distributed Resources

Technology providers—those marketing-beating, spreadsheet-wielding firms—are racing to define what a “reliable” grid actually costs and how to measure it. Distributed energy resources (DERs) like rooftop solar, battery storage, and microgrids are no longer niche experiments; they are the anticipated counterweights to network fragility. The outage forced a pragmatic reckoning: reliability cannot be achieved by one device or one protocol alone. It will require integrated systems thinking—coordinated soft and hard infrastructure, real-time data sharing, and new business models that monetize uptime as a service.

In the near term, city officials and utility leadership will likely accelerate pilots around resilience-as-a-service. This means pre-emptive maintenance dashboards, performance-based procurement, and insurance products that price outages as a measurable risk—rather than a binary event. The upside for well-positioned players is substantial: faster fault isolation, shorter restoration windows, and consumer-facing tools that translate complex grid dynamics into actionable choices (such as when to draw from storage during peak demand).

The Path Forward

What does this mean for San Francisco’s longer arc? The blackout tightens the moral and economic logic for a more distributed, flexible grid. It also sharpens the market’s appetite for data-driven reliability metrics, independent verification, and architecture that decouples critical loads from nonessential demand. If the city’s power stability can be materially traded—if uptime becomes a priced asset—then resilience upgrades migrate from the periphery to the core of capital allocation. The narrative shifts: reliability is not a benevolent public good; it is an investable capacity, with clear performance criteria, transparent accountability, and tangible returns.

The event will be analyzed in conference rooms and boardrooms across the region for months to come. What remains constant is the central thesis that the cost of reliability is not merely the sum of new wires and batteries. It is the creation of a market-ready understanding of what it means to keep a modern metropolis alive when the grid is stretched. San Francisco did not merely endure an outage; it authored a blueprint for pricing resilience, aligning public purpose with private discipline.

Conclusion, in one compressive breath: resilience is now a tradable value, and the markets are learning to price uncertainty with precision, turning failure into forecast.

In the end, the blackout is a brutal reminder that networks, like narratives, resist inertia only until action—measured, audacious, and well-funded—takes hold. As the city and its financiers recalibrate, they illuminate a path where reliability is not a bystander’s hope but a strategic asset with definable, measurable, and investable outcomes.

For readers seeking to track the trajectory, the map is now legible: efficiency, redundancy, and measurement will drive the next cycle of grid modernization. And in that mapping, San Francisco writes the rules of a new reliability economy—one where a city’s blackouts become a market signal, not merely a moment of inconvenience.

Tags

Related Articles

Sources

Preliminary statements from the utility, city officials, independent grid analysts, and market observers; corroborated by outage logs and secondary satellite imagery.