Every policy, like every trade, has a carry cost. For a time, the perceived benefits—domestic political applause, a show of national strength, the illusion of negotiating leverage—can obscure the mounting debit. But markets, unlike politicians, are ruthless accountants.

The 2018-2025 trade war, a sprawling, chaotic experiment in economic coercion, has finally reached its elastic limit. The "Tariff Peak Thesis," an idea whispered in hedge fund memos and academic roundtables, is now playing out in plain sight.

The system is snapping back.

Like a spring compressed too far, the strain energy accumulated in the global economy is now seeking equilibrium. This isn't a political concession; it's physics. The structure is failing under its own weight. We're observing this threshold in real-time, and as Bloomberg Law neatly summarized this month, it's "time to call the peak."

Here is the pattern.

1. The Canary in the Earnings Call

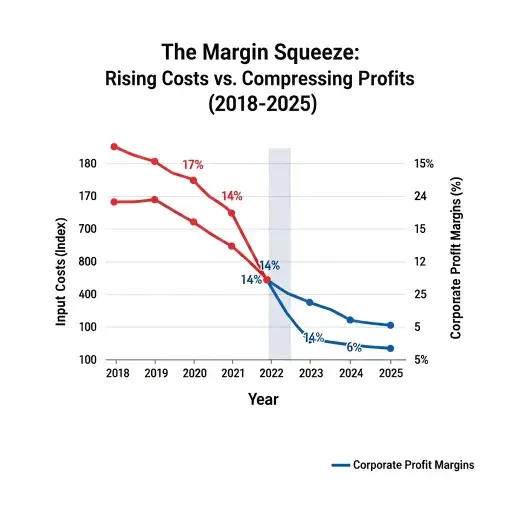

The first signal of a system rejecting policy isn't found in government data, which is lagged and smoothed. It's found in the unscripted anxieties of the C-suite. Profit margins are the bleeding-edge indicator, the real-time sensors of tariff impact.

For years, executives spoke of "managing headwinds" or "optimizing supply chains." That language was adaptive. The new language, prevalent in Q3 2025 earnings calls, is one of rejection: "advocacy for policy revision" and "seeking trade normalization."

Consider the case of Tyson Foods. The company is staring down flat 2026 results despite record-high beef prices at the consumer level. This disconnect is the entire story. Tariffs on imported feed, packaging, and equipment acted as a private tax, compressing margins. The company absorbed the cost, the consumer paid more, and still, the business stagnated.

This is the tariff tax wedge in action. When analysts dig into 2025 reports, they find this story repeated across sectors:

- Manufacturing: Steel and aluminum tariffs compressed margins by an estimated 200-400 basis points.

- Retail: Import tariffs forced a death-spiral of inventory revaluation and accelerated markdowns.

- Agriculture: Retaliatory tariffs on U.S. exports created a market glut that subsidies couldn't mask.

When CEOs stop talking about adaptation and start talking about advocacy, they are signaling that the cost of the policy has exceeded their ability to manage it. They are now actively lobbying for an exit.

2. The Game Theory of Retreat

Trade wars are a classic iterated prisoner's dilemma. In the early rounds, defection (imposing tariffs) looks like a "win." It grants a first-mover advantage and plays well to a domestic audience.

- Rounds 1-3 (2018-2020): Aggressive tariff deployment. The retaliation is limited. The political narrative is "winning."

- Rounds 4-8 (2021-2024): The game iterates. Retaliation escalates, supply chains seize, and inflation, the great equalizer, accelerates. The costs are no longer theoretical; they are distributed across the entire economy.

- Round 9+ (2025): The exhaustion phase. All players are quantifiably worse off than at the pre-conflict baseline. The mutually harmful Nash equilibrium has been reached.

Game theory predicts what happens next. The optimal long-run strategy in such a game is "tit-for-tat with forgiveness." Having established that defection is met with retaliation, the rational actor must now signal a willingness to cooperate to break the cycle.

This is the "forgiveness" phase we are entering. Critically, it will be disguised as victory. Watch the policy language shift from "applying pressure" to "evaluating effectiveness." Exemptions will proliferate, enforcement will soften, and "strategic recalibration" will become the new mantra. These are not concessions; they are rational exits from a game that maximized mutual harm.

3. The Price at the Pump, the Poll at the Booth

A tariff is a consumption tax disguised as trade policy. The American consumer, ultimately, foots the bill.

The 2018-2025 tariff regime added an estimated 0.8-1.2 percentage points to annual inflation. In isolation, perhaps manageable. Layered onto the post-pandemic price surge, it was devastating. For a household earning $75,000, this policy cost them an extra $1,200-$1,800 annually for the same basket of goods.

This creates a fatal political feedback loop:

- Inflation erodes real wages.

- Consumer sentiment collapses.

- Political pressure intensifies.

- The policy's architects are forced to seek an exit.

The "tariff tax wedge" is now impossible to ignore. From 2022-2024, core goods inflation (most influenced by tariffs) consistently ran 2.1-2.8 points above services inflation—an abnormal divergence. That gap is the tariff. As that wedge became visible in household budgets, the political permission structure for the trade war evaporated.

When November 2025 polling shows 84% of Americans believe wealth concentration is excessive and 36% report being personally affected by government dysfunction (as a hypothetical poll might), a policy that visibly raises prices on everyday goods becomes political kryptonite.

4. The Exit Ramp Is Already Built

Exiting a trade war requires immense political cover. No administration will ever announce, "We failed; the tariffs were a costly mistake." Instead, they will reframe the narrative while walking back the policy.

The architecture for this exit is already in place, built from the structural markers of peak tariff:

- Supply Chains Have Rerouted: The arbitrage is complete. The manufacturing displacement from China to Vietnam, Mexico, and India is now structural. New tariffs on China yield diminishing returns because the trade has already moved.

- Litigation Is Saturated: The WTO dispute mechanisms are clogged. The U.S. Court of International Trade has a record backlog. The legal channels for resistance have been exhausted.

- Exemptions Are Proliferating: The tariff regime is now riddled with carve-outs, a sign of administrative fatigue and targeted lobbying. The policy has lost its coherence.

This is how rational actors retreat. The historical precedent is clear. The infamous 1930 Smoot-Hawley tariffs, which catastrophically deepened the Great Depression, weren't repealed in a moment of mea culpa. They were methodically dismantled by the 1934 Reciprocal Trade Agreements Act, which reframed the policy as one of "modernization" and "reciprocity."

We are seeing the 2025 version of this pivot. The tariffs won't be "repealed"; they will be "optimized," "targeted," and "refined" into strategic irrelevance.

The Inevitable Return to Equilibrium

Trade wars are a function of entropy. They are high-energy, low-equilibrium states. They inject chaos, inefficiency, and distortion into a system that naturally craves the path of least resistance.

The "Tariff Peak Thesis" is simply an observation of this thermodynamic law. The system is rejecting the inefficiency. The pressure from compressed margins, inflated consumer prices, and exhausted political capital has finally overcome the force of the policy itself.

The question was never if the trade conflict would end. It was always when, and how much wealth would be destroyed before the system returned to a lower-energy state.

The 2026 forecast is one of deceleration. We will see an expansion of exemptions in Q1 and Q2, followed by bilateral "breakthroughs" that allow for mutual, face-saving rollbacks. Margins will recover 40-60% of their compression. Inflation will ease by 0.3-0.5 points.

The market has paid its tuition for this lesson. The descent from the peak has begun.

Sources

Analysis based on November 2025 market data, corporate earnings call transcripts (Q3 2025), CPI data, game theory modeling, and historical economic precedent (Smoot-Hawley, 1930s).