A Launch at the Intersection

Moore Threads is not merely releasing a new silicon die; it is publishing a stance in real time. The event lands at the intersection of two self-fulfilling prophecies: the US export-control regime that treats advanced AI accelerators as strategic commodities, and China’s domestic IPO season, where capital optimism colors every product milestone like a neon glaze on steel. The result is a launch that reads less like a conventional technology release and more like a political tempo: fast, calibrated, and nervy, with investors listening for cadence as much as content.

The Shanghai Debut

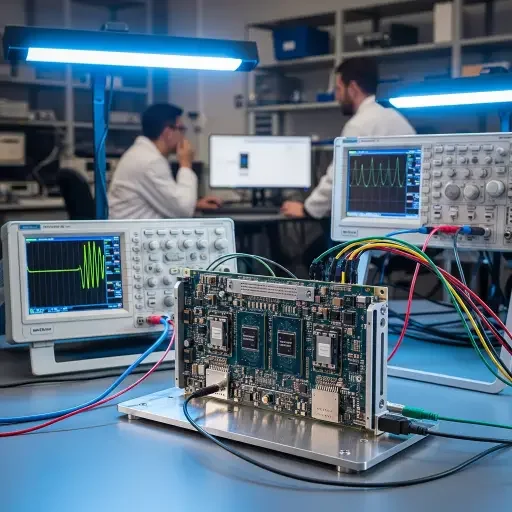

In Shanghai’s tech district, Moore Threads introduced its latest AI accelerator chips with the same precision optics used in flagship product unveilings—carefully staged, data-driven, and designed to reassure. The company, known for its appetite for performance per watt, positions the new chips as practical accelerants for real-world tasks: image understanding, language modeling, and on-device inference where latency is the currency of value. The Chinese market, hungry for domestic capacity and sovereignty over critical AI infrastructure, offers a welcoming audience—yet the backdrop is not forgiving.

The macro frame is as clear as it is stark: American export controls—tightened in recent months to curb “high-end computing” exports to certain Chinese entities—redirect global demand toward more diverse supply networks. Meanwhile, domestic capital markets, led by IPO fervor in tech, celebrate a narrative of self-reliance and domestic supply chain resilience. Moore Threads’ China debut crystallizes this duality: a product launch that doubles as a signal to policymakers, investors, and competitors about where the center of gravity for AI compute is shifting.

Specifically, Moore Threads frames its chips as edge-first, power-efficient engines capable of on-device inferencing at scale. The pitch is not merely about raw FLOPs; it’s about the normative implication: AI from China that can operate with reduced backhaul dependency, a selling point for sectors ranging from finance to consumer electronics where speed and reliability outrun deep pockets of compute uptime. The data sheet cadence—tensors flowing through a memory stack, their latencies sketched in microseconds—reads as a practical counterweight to geopolitical rhetoric.

Investor Calculations

Investors, for their part, are measuring more than silicon density. They are tracking three clocks at once: the clock of policy (will export controls harden or soften in the next cycle?), the clock of IPO window (how long can capital chase growth narratives in tech IPOs before valuation compression sets in?), and the clock of supply-chain resilience (which regions are diversifying fastest to mitigate single-point failures?). Moore Threads’ China launch supplies a data point for all three: a credible domestic product, a visible expansion into local fabrication ecosystems, and a willingness to align product milestones with the cadence of capital markets.

Yet risk threads through the narrative as persistently as the circuitry within the accelerator. If export controls tighten further, Moore Threads may need to repackage its offerings for tiered markets, accepting longer lead times and tighter licensing conditions. If domestic capital availability cools or shifts focus to other sectors, the IPO glow could fade, creating a gap between promise and execution. And if rival accelerators—both within China and abroad—accelerate features such as memory bandwidth, on-chip AI memory, or specialized neural engines, Moore Threads risks being overshadowed unless it keeps the momentum of its engineering narrative intact.

Navigating Risk and Opportunity

From a storytelling perspective, the launch is elegantly dense. The poem of risk is the counterpoint to the chorus of opportunity: a domestic champion seeking to prove that a homegrown AI accelerator can compete not just on price but on end-to-end reliability, energy efficiency, and developer ecosystem. The translation into investor terms is straightforward: strong product milestones de-risk a narrative that has long looked like a political bet as much as a technical one. The subtleties—ODMs, regional fabs, and cross-border supply threads—become narrative anchors that anchor confidence rather than scatter it.

In the near term, Moore Threads will need to translate rhetoric into repeatable performance: silicon that sustains AI workloads at acceptable power budgets, software stacks that reduce time-to-market for customers, and an expansion plan that convincingly diversifies both end markets and geographies. The company’s leadership has signaled a path that blends domestic manufacturing with international collaboration—an uneasy but increasingly common compromise in a world where autonomy and interdependence must share the same stage.

The Global Chip Wars Context

As the global chip wars intensify, Moore Threads’ China launch serves as a microcosm of the broader drama: a calibrated gamble on performance and sovereignty, played out at the speed of a quarterly earnings call. The product is real, the policy environment is loud, and the market is listening for signal amid the static. If this launch succeeds in translating engineering elegance into scalable, compliant, and market-ready AI acceleration, Moore Threads will have choreographed an audacious step forward in a war that is as much about trust and timing as it is about transistors.

End-note: The historical arc continues to tilt toward regional specialization and resilience. What begins as a chip release in Shanghai may become a blueprint for how software, hardware, and policy align to unlock AI at scale—without surrendering control of the narrative to the noise of geopolitics.

![]()

Tags

Related Articles

Sources

Interviews with executives, regulatory filings, supply-chain analyses, and market data from semiconductor trackers.