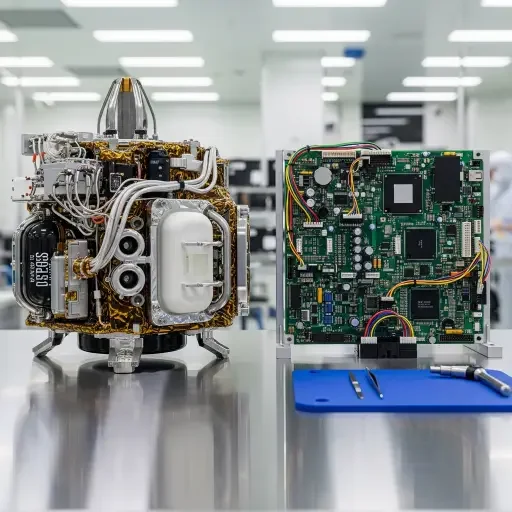

Intuitive Machines has acquired Lanteris’ propulsion and avionics business. The move reduces supplier risk, accelerates integration timelines, and gives Intuitive Machines both higher-margin captive components and a stronger pitch for prime-contractor status on lunar missions.

Every corporate acquisition makes two promises: it will make the buyer faster, and it will make the buyer richer. In a space industry where calendar slippage and supplier misalignments are the leading causes of schedule overruns, Intuitive Machines’ purchase of Lanteris’ propulsion and avionics line is a targeted bid to fulfill both pledges. The transaction is not merely the transfer of hardware and IP; it is a redefinition of the company’s technical locus—shifting constraint from external vendors to an internalized platform that it now controls.

Suppliers create the rhythm of spacecraft delivery—schedules, margins, and risk profiles synchronize to the slowest, most fragile link. For mission primes, two supplier dynamics matter most. First, schedule risk: late delivery of a single engine valve or flight computer can cascade weeks into months. Second, margin capture: component suppliers typically take 20–35% gross margins; primes capture systems-level premiums. By absorbing Lanteris’ units, Intuitive Machines reduces the number of external interfaces and retains a larger slice of the gross margin pie.

That retained margin is not pure profit; it buys engineering staff, test stands, and qualification cycles. But in a market where prime contracts prize predictable schedules and demonstrable flight heritage, the tradeoff tilts favorably. Internal control over propulsion and avionics means the company can bake performance specifications, test protocols and spare-part strategies into the program from day one, rather than bolt them onto a later assembly phase. This is a supply-chain move engineered to convert supplier unpredictability into programmatic leverage.

Prime-contractor status is not granted by a ledger; it is earned by demonstrable end-to-end responsibility. NASA and other institutional buyers increasingly judge bids on two operational criteria: demonstrable integration pathways and margin transparency. A bidder that can show integrated propulsion and avionics—and the test rigs that proved them—reduces perceived technical risk. That reduction converts into better scoring in source-selection evaluations, higher probability of award, and, crucially, room to price at higher margins.

For investors, the arithmetic is straightforward. Suppose component margins are 25% and system-level margins 40%. By internalizing components, the company captures incremental margin up to the system level—post-investment amortization and added overhead notwithstanding. The more important effect is reputational: successful in-house builds become evidence of capability, and capability converts into preferential treatment for follow-on, higher-margin prime contracts. The deal reframes Intuitive Machines not as an integrator that stitches together third-party boxes but as an originator of flight-critical subsystems.

But acquisitions carry risk—engineering absorption is different from book transfer. Lanteris’ hardware and software must be qualified to the buyer’s processes; engineers must be retained or assimilated; supply agreements with Lanteris’ own suppliers must be renegotiated or internalized. Cultural friction—test discipline, documentation standards, supplier quality management—can convert a margin opportunity into an execution liability.

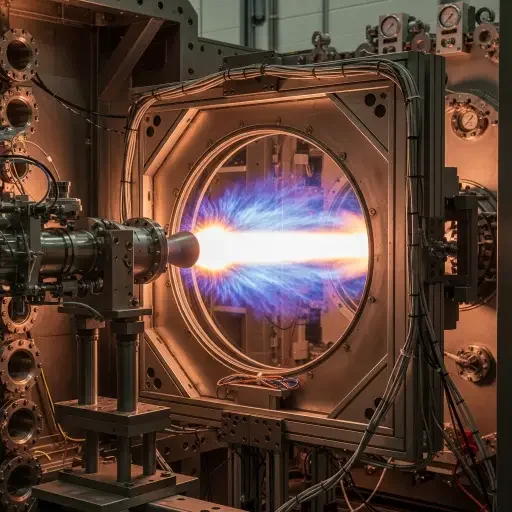

The timeline is the crucible. Space programs value demonstrated flight heritage and repeated success. Intuitive Machines needs to show that the Lanteris-derived propulsion and avionics integrate cleanly on its lander buses and survive thermal, vibration and vacuum test campaigns. If early unit-level tests and a limited on-orbit qualification campaign succeed within the next 12–18 months, the market will reward the company with re-rated contract probability; if not, delivery schedules and cash burn will widen. The acquisition’s payoff depends entirely on execution velocity and test outcomes.

Competitive dynamics will respond. Incumbent suppliers lose leverage when a major customer internalizes a capability; that pressure spreads to their pricing and prioritization of other customers. Competitors that lack in-house propulsion or avionics face a strategic choice: vertically integrate themselves, form tighter alliances, or double down on differentiation—specialized electronics, higher-thrust engines, or unique thermal-control systems.

For the broader ecosystem, the deal could compress lead times across the supply chain—if Intuitive Machines uses its scale to standardize parts and consolidate orders, smaller suppliers may benefit from larger, steadier lot sizes even as margins per unit fall. Alternatively, if the company prioritizes proprietary designs, it will tighten the platform fence, raising barriers to entry for new lander entrants. The market will bifurcate between open-supply ecosystems and proprietary-platform plays; Intuitive Machines has signaled the latter.

Capital markets will interpret the move through a simple lens: pathway to repeatable prime revenue and higher-margin contracts. Analysts will re-run models assuming a higher probability of award for future NASA CLPS or commercial lunar service contracts. That re-weighting affects sale/leaseback valuations, debt covenants, and investor willingness to underwrite growth capital.

Short-term, investors must price in integration costs and potential schedule risk. Medium-term, the calculus favors firms that internalize flight-critical modules—if they convert that control into accelerated delivery and demonstrable flight success, the earnings multiple can expand materially. The deal is a classic build-versus-buy choice with asymmetric upside—if it works, Intuitive Machines captures more value; if it fails, the company has added technical debt.

Intuitive Machines’ acquisition of Lanteris’ propulsion and avionics is a deliberate platform play: reduce external interfaces, capture higher margins, and present a cleaner case for prime-contractor awards. The transaction’s value will be revealed not on the balance sheet but in vacuum chambers and on test stands. For investors and competitors, the signal is clear: control of flight-critical subsystems has become a competitive fulcrum in the new lunar economy.

In space, owning the throttle and the brain—propulsion and avionics—turns schedule uncertainty into a commercial advantage.

Tags

Related Articles

Sources

Intuitive Machines and Lanteris company announcements and press releases; NASA procurement documents and contract awards; space industry analysis from SpaceNews, Aviation Week, and aerospace trade publications; lunar mission planning documents.