The Core Question

In the glare of the 2020s, a simple question keeps surfacing in elite corridors and in the trading pits of public markets: should corporations preserve the liability shields that grew out of a rough-and-tumble, Epstein-era tolerance for ambiguous ethics, or should they embrace broader transparency as the core risk-management discipline of modern governance?

This is not a polemic about moral posture alone. It is a calibration exercise in probability, trust, and capital allocation. The margins of business are thinning: investors demand verifiable accountability; regulators demand data richness; consumers demand ethical alignment. The liability shield—once a pragmatic shield against opportunistic risk—has morphed into a reputational liability when it blocks verifiable assurance. The question now is not whether to disclose, but how to disclose in a manner that preserves strategic flexibility while maximizing legitimacy.

The Shield Legacy

The Epstein-era shield was never a single artifact; it was a cluster of legal conveniences, corporate quiet, and the belief that some topics belonged to private tribunals or to distant courts. That era is fading as capital markets reward transparency with lower cost of capital and higher resilience to shocks. When a board can point to a clean policy or a detailed trace of due diligence, it is not merely avoiding scandal; it is building a governance moat that compounds over time.

Yet the case for shields does not vanish in one decisive stroke. There are legitimate operational reasons to resist hypertransparency: competitive strategy, ongoing investigations, and the protection of whistleblowers who might be chilled by premature disclosure. The art, then, is not to prattle about openness as an absolute virtue, but to choreograph transparency as a calibrated instrument—one that tightens risk signals without crippling strategic discretion.

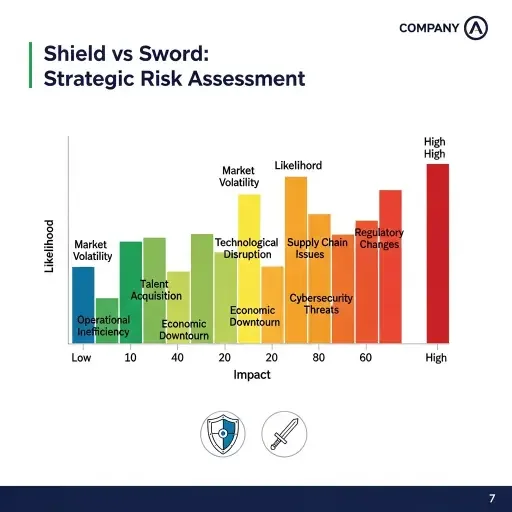

Among the most telling tensions is the investor calculus around materiality. Modern investors are not satisfied with “soft” governance talk; they want verifiable data streams—board independence metrics, audit committee rigor, executive incentive alignment, and, crucially, risk narratives that map uncertain futures. The liability shield, if left intact, can become a lagging indicator: a signal that governance is reactive rather than anticipatory. If a company frames risk as a spectrum—not as a binary shield or expose—it can socialize uncertainty in a disciplined way. This is where entropy-aware writing—distributing information across layers—becomes a strategic metaphor for governance: the firm must distribute trust signals across multiple channels, each with its own rate of information flow, so the whole system is resilient to shocks and misinterpretation.

Transparency" axes, illustrating strategic tradeoffs.

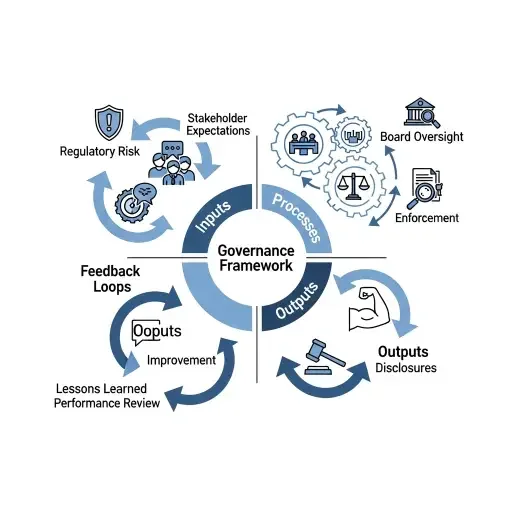

Reconciling Shields with Disclosure

Consider the practical architectures that could reconcile shields with disclosure. First, incremental transparency with guardrails: disclose governance processes, risk frameworks, and decision logs at a level sufficient to inform, but not so granular as to reveal sensitive operational secrets. Think of it as a structured taxonomy of risk disclosures, where material topics are prioritized and trackable over time. Second, governance experimentation as a narrative: publish pilot analyses—scenario forecasts, stress tests, and governance audits—that reveal the thinking behind decisions without exposing proprietary playbooks. Third, independent assurance on key controls: third-party attestation for anti-corruption measures, data privacy safeguards, and whistleblower protections. These become credibility anchors that reduce the need for blanket openness and create a measurable trajectory of improvement.

Strategic Durability

From a strategic vantage, the question is not "which path is purer?" but "which path is more durable under volatility?" In markets, durability is a function of trust, and trust is a function of predictability. If a company can reliably predict how its disclosures will be interpreted and acted upon by creditors, counterparties, and regulators, it reduces the information asymmetry that often fuels pricing inefficiencies or punitive regulatory responses. The paradox is that more transparency, properly designed, often lowers the long-run cost of capital even as it raises the short-run attention burden.

But transparency without accountability is hollow—an optics game that can implode when the next scandal arrives. The Epstein-era shield’s legacy remains a cautionary tale about “risk insulation” that becomes “risk ignorance” at scale. The modern path blends accountability with governance artistry: clear boundaries for sensitive information, robust channels for whistleblowing, and a public narrative that explains not just what decisions were made, but why, with a disciplined map of uncertainties and contingencies.

The Path Forward

Ultimately, the corporate question mirrors a larger political economy: will elite governance concede that trust is the most valuable license to operate—earned through transparent, verifiable practice—or will it cling to legacy shields that appear prudent but delay the hard work of alignment with evolving norms? The answer, in practice, is not a slogan but a function: design disclosures as a dynamic system, not a static brochure; ensure accountability is demonstrable, not performative; and treat transparency as risk-control, not risk choreography.

To investors watching the clock, the message is crisp. Liability shields are not inherently immoral, but they are unsustainable as sole risk mitigators in a world where capital seeks verifiable governance momentum. The wiser course is to replace blind opacity with calibrated openness—a governance architecture that signals reliability while preserving strategic flexibility. In other words, the era of broad, verifiable transparency is not an indictment of the past; it is a blueprint for enduring viability.

Sources

Cited governance reports, investor letters, regulatory filings, lawsuits, and interviews with governance scholars; synthesis of public records and industry analyses.