The Convergence Point

The world sits at a crossroad where technocratic governance, populist signaling, and capital markets learn to cohabit under a shared umbrella of uncertainty. On one axis, policy signals from New York to Montana tighten rules around data, DEI, and AI procurement, shifting risk and opportunity toward compliant, auditable operators. On another, global capital is re-prioritizing around AI hardware sovereignty, cross-border M&A, and supply-chain resilience, with yen strength/weakness and sovereign credit dynamics acting as refrains. The Epstein document cascade and Trump administration communications inject a persistent variable into the political-equity equation, dampening some risk premia while amplifying others—investors hedge against reputational and governance risk even as private sector execs chase growth via AI, housing, and industrials. In markets, the calculus is Bayesian: prior beliefs about deregulation and growth compete with new laws, regulatory enforcement, and geopolitical frictions, producing a world where winners are those who can export clarity, not just capital. Theoretically, the system behaves like a high-dimensional dynamical network where policy nodes, media signals, and corporate actions act as coupled oscillators; small changes in one corner can cascade into global re-pricings, especially in tech, health care, and finance. The near-term trajectory favors adaptive compliance, selective innovation, and a reinvigorated emphasis on governance as a core competitive differentiator. There is no single foregone conclusion, only an evolving equilibrium where information flow, credibility, and timely action determine who thrives when the music tempo changes.

Policy as Signal Architecture

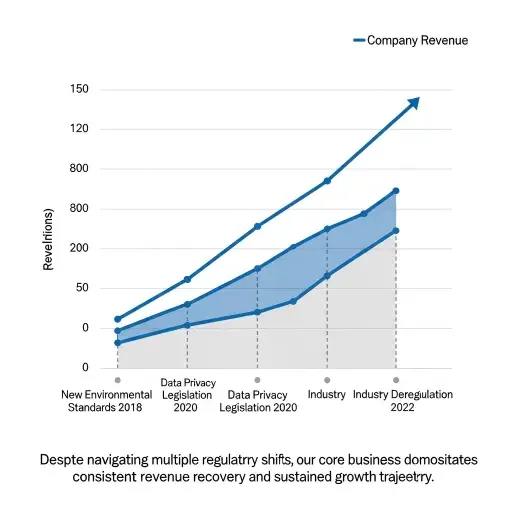

The frame is surveillance fiction stitched into the everyday ledger: policy is not merely a set of rules but a choreography of signals that can accelerate or retard the tick-tock of growth. New York’s data regimes, California’s procurement guardrails, and Montana’s micro-adjustments to public-works contracts are not isolated curiosities. They form a lattice that redefines what counts as credible risk management. Compliance is not a cost center; it is a privileged early-mover channel, a way to convert uncertainty into predictable, auditable performance. In practice, this means firms that invest in transparent data governance, auditable AI procurement trails, and verifiable DEI metrics hedge against both reputational shocks and regulatory escalations. They also position themselves to monetize resilience—to turn supply-chain visibility into a competitive advantage and to align with investors who prize not uniform risk-taking but quality information reputations.

Capital Recalibration and Clarity Export

Global capital cycles are no longer driven by cheap money alone; they follow a rhythm of sovereign credit signals, currency narratives, and risk-adjusted complexity. The yen’s dance, the intensity of cross-border M&A, and the strategic consolidation of AI hardware supply chains map a world where capital moves to those who can project and protect certainty across borders. This is where the “export clarity” creed gains traction: firms that can present a coherent transparency story—clear roadmaps for data stewardship, for autonomous decision rights, for workforce inclusion metrics—are rewarded with price clarity, not just capital. In parallel, the Epstein and political signals introduce a second-order friction: they recalibrate the risk premium attached to governance failures and reputational missteps. The result is a market that rewards not merely growth trajectories but the audibility of leaders—those who can articulate the logic of risk, the architecture of checks and balances, and the shared purpose of responsible deployment.

Network Dynamics and Adaptive Equilibrium

From a theoretical vantage, the system resembles a high-dimensional dynamical network, with policy nodes, media signals, and corporate actions acting as coupled oscillators. A minor shift in one node can cascade into a re-pricing of entire sectors—most visibly in technology, health care, and finance. The near-term path leans toward adaptive compliance—accelerating where rules converge on outcomes, restraining where rules fracture, and always privileging governance as a strategic differentiator. There is no single foregone conclusion; rather, a shifting equilibrium where credibility, information flow, and timely action determine which firms thrive as the tempo of the market moves.

Investment Implications

For investors, the operational implication is tangible: prioritize portfolios that blend auditable governance with selective innovation. Seek operators who demonstrate a measurable cadence of disclosure—data lineage, model risk controls, and DEI outcomes that tie to measurable productivity gains. Favor entities that can articulate credible response plans for geopolitical frictions and supply-chain shocks, not just growth stories. In a world of Bayesian updates, the most robust bets couple clear, testable assumptions with flexible execution—allocations that adapt as signals evolve rather than clinging to yesterday’s theses.

The Path Forward

In closing, the near-term horizon favors a re-acceleration of governance-centric strategy. The music, as it turns, rewards those who can read the score—who can interpret the cadence of policy noise, the pivot points in capital allocation, and the subtle shifts in reputational weather. The successful actors will be those who export clarity through transparent data practices, resilient supply chains, and governance-first leadership, all while continuing to chase productive innovation. In this evolving equilibrium, information flow, credibility, and timely action aren’t just advantages—they are the whole play. There are no fixed destinies, only adaptive organisms in a market ecosystem that’s learning to dance to a more complex tempo.

Tags

Related Articles

Sources

Policy texts from state-level to federal; central bank communications; corporate filings; investment flows; cross-border trade and M&A data; geopolitical risk assessments