The boards of both companies approved the transaction, which structures consideration as approximately 73 percent cash and 27 percent stock. Penumbra shareholders can elect to receive either $374 cash or 3.8721 Boston Scientific shares per Penumbra share, subject to proration. Boston Scientific plans to finance the approximately $11 billion cash portion through cash on hand and new debt.

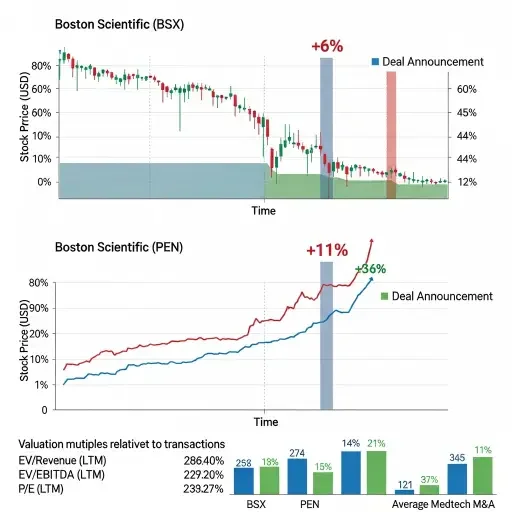

Markets reacted with caution to the valuation. Boston Scientific shares fell more than 6 percent following the announcement while Penumbra stock rose approximately 11 percent, though it traded below the $374 takeout price as the stock component declined in value alongside Boston Scientific shares. The deal values Penumbra at roughly 9.2 times estimated fiscal 2026 sales—a premium that reflects both competitive bidding dynamics and strategic positioning in fast-growing vascular intervention markets.

Penumbra brings approximately $1.4 billion in expected 2025 revenue, representing growth of 17.3 to 17.5 percent year-over-year. The company reported fourth quarter revenue growth of 21.4 to 22 percent, demonstrating momentum that justifies the acquisition premium. Its mechanical thrombectomy systems—including the Lightning Bolt and Lightning Flash computer-assisted vacuum thrombectomy platforms—received FDA clearance in 2023 and 2024 and have captured market share from established competitors.

Boston Scientific CEO Mike Mahoney described Penumbra as offering entry into new, fast-growing segments within the vascular space where Boston Scientific currently lacks offerings. The acquisition complements Boston Scientific’s existing AngioJet thrombectomy system, inherited through the 2014 acquisition of Bayer’s interventional division, while adding neurovascular capabilities that operate in different anatomical territories.

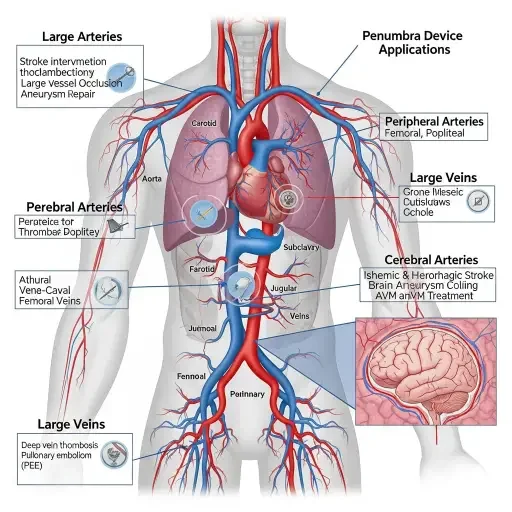

Penumbra’s portfolio addresses pulmonary embolism, ischemic stroke, deep vein thrombosis, acute limb ischemia, heart attack, and aneurysms. The company also manufactures peripheral embolization systems designed to control hemorrhaging and bleeding or close blood vessels. These technologies treat conditions where blood flow disruption—either through clots or uncontrolled bleeding—creates immediate clinical risk.

Cardiovascular diseases remain the leading cause of death globally, driving sustained demand for advanced intervention tools. Aging populations in developed markets and rising chronic disease prevalence in emerging economies create structural growth across the sector. Minimally invasive techniques that remove clots without thrombolytic drugs offer clinical advantages including reduced bleeding risk and faster intervention in emergency settings.

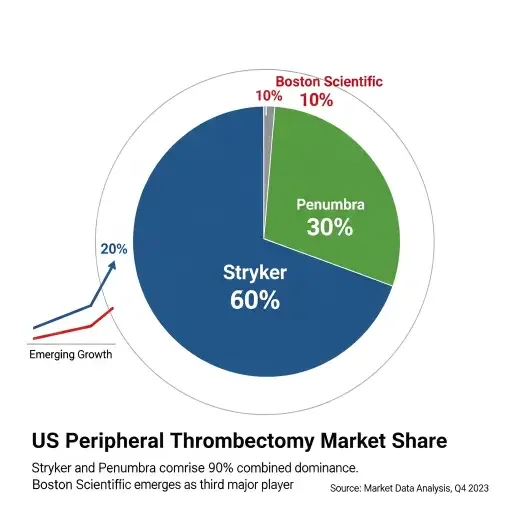

The transaction puts Boston Scientific in direct competition with Stryker in peripheral thrombectomy markets. According to GlobalData analysis, Stryker and Penumbra together comprise almost 90 percent of U.S. market share in peripheral thrombectomy, with Penumbra currently holding the top position driven by favorable sales of its Lightning Flash device. Boston Scientific’s entry consolidates the competitive landscape into a duopoly structure that could influence pricing power and innovation trajectories.

Stryker’s $4.9 billion acquisition of Inari Medical in February 2025 made Penumbra a more attractive takeover target by validating high valuations for thrombectomy assets. Inari’s FlowTriever system for pulmonary embolism and ClotTriever for peripheral vessel thrombectomy represented technologies that Stryker lacked in its neurovascular business. The Inari deal demonstrated that large medtech companies would pay premium multiples to enter fast-growing procedural markets rather than develop competing technologies internally.

RBC Capital Markets analyst Shagun Singh noted that Penumbra had been considered a takeover candidate for some time. The company’s growth profile, differentiated technology platform, and position in high-value clinical segments created strategic optionality that multiple acquirers could justify. BTIG analyst Ryan Zimmerman characterized the acquisition as bringing Boston Scientific a growth asset in thrombectomy and embolization while enabling geographic expansion of Penumbra’s predominantly U.S.-based business through Boston Scientific’s global commercial infrastructure.

The deal follows Boston Scientific’s acquisition earlier this week of Valencia Technologies, a bladder dysfunction specialist whose eCoin tibial nerve stimulation system treats urge urinary incontinence. Terms were not disclosed for the Valencia transaction, which represents a smaller tuck-in acquisition targeting urology markets. The pairing of Valencia and Penumbra within the same week demonstrates Boston Scientific’s active portfolio construction ahead of the J.P. Morgan Healthcare Conference taking place this week in San Francisco.

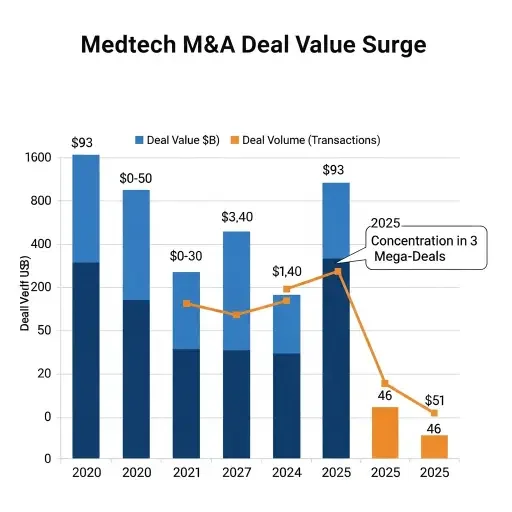

Medtech M&A activity surged to $92.8 billion in 2025—the highest level in more than a decade—according to PwC’s US Deals 2026 outlook. However, only 46 deals were announced through November 30, indicating that aggregate value concentrated in a small number of mega-transactions rather than broad-based activity. Three deals dominated: Abbott’s $23.5 billion acquisition of Exact Sciences, Blackstone’s $20.5 billion take-private of Hologic, and Waters Corporation’s $17.5 billion purchase of Becton Dickinson’s biosciences and diagnostics unit.

The concentration reflects a bifurcated market where large strategics pursue transformational acquisitions while mid-sized transactions remain constrained by regulatory uncertainty, macroeconomic pressure, and elevated financing costs. Deal timelines have lengthened as buyers conduct more extensive diligence on supply chains, data flows, manufacturing footprint, and regulatory exposure. Structured capital solutions including staged transactions and minority investments have become more common as acquirers manage risk while maintaining strategic upside.

PwC analysis suggests 2026 will see continued consolidation as strategics realign portfolios around growth priorities and private equity remains an active capital source. Activity is expected to concentrate in innovation-led categories including diagnostics, surgical robotics, cardiovascular intervention, and connected care platforms that enable data-driven clinical workflows. The regulatory environment has become more accommodating to deals, particularly as antitrust reviews incorporate behavioral remedies rather than structural prohibitions.

Abbott’s acquisition of Exact Sciences—expected to close in second quarter 2026—signals appetite for molecular diagnostics and data-driven testing platforms. The deal adds cancer screening capabilities including Cologuard to Abbott’s diagnostics portfolio, which already spans infectious disease, cardiometabolic biomarkers, and point-of-care testing. Abbott CEO Robert Ford characterized the acquisition as a long-term bet on clinical need across global healthcare markets rather than near-term financial optimization.

Hologic’s $18.3 billion take-private by Blackstone and TPG represents private equity’s expanded role in medtech consolidation. The transaction removes a women’s health leader from public markets, giving sponsors operational flexibility to invest in product development and geographic expansion without quarterly earnings pressure. Private equity participation in medtech has accelerated as sponsors build specialized platforms with operational expertise and defensible market positioning.

Boston Scientific expects the Penumbra acquisition to be $0.06 to $0.08 dilutive to adjusted earnings per share in the first full year following close, neutral to slightly accretive in the second year, and more accretive thereafter. The company plans to operate Penumbra essentially as a standalone organization within its high-growth cardiovascular group, preserving the target’s operational culture while leveraging Boston Scientific’s supply chain capabilities and global commercial reach.

Penumbra chairman and CEO Adam Elsesser will join Boston Scientific’s board upon deal close. Elsesser indicated he will elect to receive Boston Scientific shares for all his Penumbra holdings, aligning incentives between the acquired company’s leadership and the combined entity’s performance. This structure mirrors successful integrations where founder-operators maintain equity stakes and board representation, reducing the risk of key talent departure that can undermine acquisition value.

The transaction requires Penumbra shareholder approval and satisfaction of customary closing conditions including regulatory clearances. Boston Scientific expects to complete the acquisition by the second half of 2026. Antitrust review will likely focus on market concentration in peripheral thrombectomy given Boston Scientific’s existing AngioJet platform and Penumbra’s market-leading position, though behavioral remedies around catheter supply access or distribution arrangements could address competitive concerns without blocking the deal.

J.P. Morgan analysts led by Robbie Marcus characterized the acquisition as making strategic sense despite expected investor scrutiny. The deal provides Boston Scientific access to best-in-class products in fast-growing markets, creates cross-selling opportunities across Boston Scientific’s existing cardiovascular franchise, and enables globalization of Penumbra’s business through Boston Scientific’s established international distribution. Marcus noted that Boston Scientific’s recent success with its Farapulse pulsed field ablation technology for atrial fibrillation has driven explosive growth in its cardiovascular division, creating both financial capacity and organizational momentum for large acquisitions.

Boston Scientific’s peripheral intervention business generated $702 million in third quarter 2025, representing 16.7 percent growth from the prior year. The segment benefits from expanding indications for minimally invasive peripheral arterial disease treatment and growing awareness of venous thromboembolism as an underdiagnosed condition. Adding Penumbra’s thrombectomy and embolization technologies expands addressable markets within the peripheral vascular space while creating technological complementarity across arterial, venous, and pulmonary applications.

The neurovascular dimension represents entirely new territory for Boston Scientific. Penumbra’s stroke revascularization devices and neuroembolization systems operate in intracranial vessels where anatomical constraints, clinical urgency, and reimbursement structures differ from peripheral vascular markets. The neurointervention field has grown rapidly as evidence accumulates for mechanical thrombectomy’s effectiveness in acute ischemic stroke, with treatment guidelines expanding to include patients previously considered ineligible.

Competition in neurovascular markets includes Medtronic, Johnson & Johnson’s Cerenovus division, Stryker’s neurovascular unit, MicroVention (owned by Terumo), and Phenox. Market dynamics reflect both technological differentiation and physician preference patterns that develop through training, clinical experience, and institutional purchasing relationships. Boston Scientific’s entry adds a well-resourced competitor with cardiovascular credibility but limited neurovascular track record, creating integration risks around sales force expertise and physician adoption.

The timing aligns with broader medtech trends toward technology-driven consolidation where incumbents acquire high-growth innovators in AI, imaging, and vascular robotics to accelerate platform modernization. Boston Scientific, Stryker, and Johnson & Johnson exemplify “adjacency stacking”—acquiring businesses that add new therapy channels rather than pure revenue scale. This strategy recognizes that organic development timelines often exceed market windows for establishing competitive position in rapidly evolving procedural markets.

Private equity’s role has evolved beyond traditional platform acquisitions toward structured capital solutions including build-to-buy constructs where sponsors provide flexible financing to accelerate innovation before eventual strategic exit. Sponsors’ ability to underwrite complex value-creation plans keeps them competitive against strategics in high-growth segments, particularly where regulatory pathways or reimbursement structures create uncertainty that financial engineering can help manage.

Policy and regulatory pressures continue shaping deal execution. The U.S. Section 232 inquiry into medical device supply chain vulnerabilities and ongoing geopolitical volatility are prompting dealmakers to adopt scenario-based diligence and flexible integration strategies. Companies emphasize operating-model adaptability and value-capture planning to mitigate potential disruptions from tariff policies, trade restrictions, or regional economic instability.

The Boston Scientific-Penumbra transaction encapsulates multiple converging forces: demographic tailwinds from aging populations, clinical evidence supporting minimally invasive intervention, consolidation dynamics in fragmented procedural markets, and capital availability at favorable terms. The $14.5 billion price tag reflects not just Penumbra’s current revenue and growth but the strategic value of market access in segments where early positioning determines long-term competitive advantage.

Whether the acquisition delivers returns depends on execution across commercial integration, technology development, and regulatory navigation. Boston Scientific’s track record includes successful large acquisitions—the $27 billion Guidant deal in 2006 eventually delivered value despite integration challenges—and stumbles where cultural misalignment or technology obsolescence undermined strategic rationale. Penumbra’s founder-led culture and physician-focused innovation model will need to survive within Boston Scientific’s structure without losing the entrepreneurial intensity that drove its growth.

For the broader medtech sector, the deal signals that 2026 will see continued consolidation as companies pursue scale advantages, technology acquisition, and market position before competitive dynamics shift. The cardiovascular space remains particularly active as the intersection of aging demographics, chronic disease prevalence, and technological innovation creates growth that justifies premium valuations and aggressive M&A strategies.

Related Articles

Sources

Research drawn from Boston Scientific and Penumbra corporate announcements, PwC US Deals 2026 outlook report, BTIG and RBC Capital Markets analyst notes, GlobalData medical device market analysis, investor conference call transcripts from J.P. Morgan Healthcare Conference, MedTech Dive industry coverage, and market data on medtech M&A activity including Abbott, Stryker, and Hologic transactions from 2025-2026.