The M&A Surge

Japan's M&A machine is not merely hot; it is calibrated. In the past twelve months, Japanese deal activity has surged toward the $350 billion mark, a figure that would be newsprint-worthy under any regime. But the tempo, the geography, and the risk calculus behind these numbers reveal something subtler: a currency-driven invitation to recalibrate capital allocation across the Asia-Pacific ecosystem. A weaker yen makes foreign assets cheaper for Japanese buyers and foreign liabilities cheaper for Japanese borrowers. In plain terms: more firepower, more confidence, more willingness to strike across borders.

The levers are both macro and micro. On the macro side, the Bank of Japan’s extended ultra-loose stance has tempered domestic borrowing costs while maintaining inflationary expectations in check. That backdrop fuels outbound investments in sectors where scale and speed matter—tech platforms, semiconductors, medical devices, and healthcare networks where consolidation can compress costs and accelerate R&D cycles. On the micro level, corporate governance reforms and investor activism have sharpened the strategic language around M&A. Boards now speak in terms of synergy, not only scale; the phrase “shareholder value via integration” has become a recurring reflex in earnings calls and deal briefings.

Regional Capital Redistribution

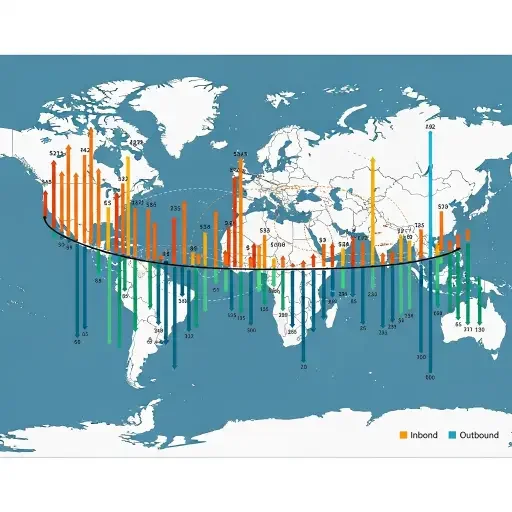

The regional map is being repainted. Japanese acquirers—a mix of conglomerates, private equity-backed groups, and challenger incumbents—are maneuvering into tech corridors in Singapore and Korea, while eyeing gateways into the United States and Europe via strategic stakes and full buyouts. The tech axis remains central: software-as-a-service platforms, cloud infrastructure, and AI-enabled analytics firms promise accelerated synergies with Japanese incumbents that have deep manufacturing ecosystems and sophisticated risk controls. Healthcare, long a bastion of domestic demand and aging demographics, now offers a second frontier: global manufacturing networks for pharmaceuticals, contract research organizations, and genomics data platforms. The yen’s weakness acts like a global positioning system, guiding capital to where scale tips the balance toward faster time-to-value.

![]()

Investor Confidence and Regulatory Alignment

Investors are watching the flow as a barometer of confidence. Cross-border deals require not just capital but a borrowed sense of predictability: regulatory alignment, tax clarity, and cultural integration all must synchronize. In Japan's case, the regulatory environment has grown more predictable for outbound investments, with authorities signaling pragmatic approvals and clear capital repatriation channels. This reduces the usual friction that has sometimes deterred aggressive outbound activity. For foreign targets, Japanese capital has moved from opportunistic to strategic: it is not merely price discovery but partnership building, joint development, and access to Japanese distribution and manufacturing ecosystems.

Governance and Integration Discipline

Wind in the sails comes with the soft currency, but the pledge remains to governance and post-merger integration. Early-stage due diligence has become more rigorous, not less: cyber risk, supply-chain resilience, and environmental liabilities sit at the negotiation table as non-negotiables. Deal cultures around the region are adapting too. Southeast Asia is increasingly viewed as a value-ladder to Japan’s strategic ambitions; Korea remains a technology hub for input into joint ventures; and North America serves as a risk-adjusted exit path and knowledge transfer corridor. This is capital choreography, where currency leverage is an accelerant, not a substitute for strategic clarity.

The market’s heartbeat is outward-facing, yet the internal governance pulse matters most for durability. Boards are increasingly insisting on clear synergy targets, with defined post-merger integration milestones and accountable leadership. The urgency is not reckless expansion; it is disciplined scale, where every deal carries a measurable path to revenue uplift and cost optimization. In technology, that means consolidating platform portfolios to realize network effects; in healthcare, it means leveraging manufacturing scale to lower unit costs and speed clinical timelines.

As 2025 closes, some observers forecast a plateau—a natural pause as regulators harmonize cross-border flows and as some deal structures shift from “buy and integrate” to “build and partner.” Yet the yen’s trajectory suggests the opposite: conditions are ripe for more cross-border capital to find its way into Japanese-led acquisitions and strategic investments. If fiscal policy and governance align with the currency regime, the next wave could push the $500 billion horizon into consideration—though only if the core thesis remains intact: durable value creation through strategic alignment, not mere financial engineering.

Strategic Inflection

In the end, Japan's $350 billion surge is less a single number than a strategic inflection. It signals a regional realignment in which Japanese capital, empowered by a weaker currency, travels farther, faster, and with greater precision. For buyers, it is a blueprint: target scale where it counts, anchor governance to protect value, and integrate with patience. For sellers and markets, it is a reminder that cross-border M&A remains not a margin tactic but a long-run re-architecting of regional ecosystems. And for observers, it offers a template: the currency as compass, the deal as instrument, and the enterprise as the enduring chorus of an economy recalibrated for the next era of globalization.

Sources

Central bank statements, corporate earnings supplements, deal announcements, and market analytics from Tokyo financial press, major brokerages, and regional journals.