The Narrative Lattice

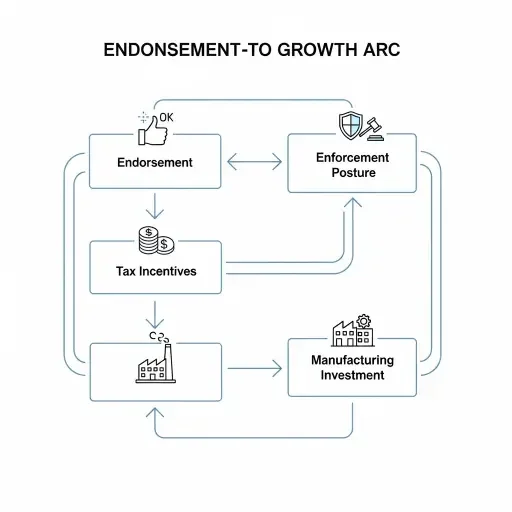

In New York, the chessboard isn't a grid of precincts; it's a lattice of narratives. And in recent months, one narrative has become unmistakably dominant: a wave of endorsements from a national figure whose bargaining power travels by tweet and by precinct. The ripple effects are not merely stylistic. They are structural, predicating shifts in who sets regulatory tempo, who benefits from tax incentives, and where manufacturing bets land in a state famed for both its financial clutter and its labor-law rigor.

Shifting Policy Discourse

From the governor's mansion to Long Island's business councils, the conversation has shifted from "how to regulate growth" to "how to catalyze growth while managing enforcement optics." The endorsements act as a liquidity infusion in a political market that prizes certainty in an environment of high-velocity information. This is not about banners at parades; it’s about how endorsements unlock policy corridors, influence procurement dynamics, and alter the risk calculus for corporate capital that might otherwise stay on the sidelines.

New York’s enterprise environment has long depended on a delicate calibration: robust public services and a rigorous legal framework, paired with incentives that coax factories and fabs to plant roots in the upstate and rust-belt-adjacent regions. The current wave seeks to accelerate that calibration by linking two levers that rarely align so cleanly in a single state: an immigration-enforcement posture that signals national alignment with border control objectives, and aggressive tax/regulatory concessions aimed at seeding manufacturing with a domestic, supply-chain renaissance. The question is not whether this will drive capital—money always follows predictability—but whether the price of certainty will be paid by workers, communities, and the state’s fiscal balance.

The Behavioral Ecology of Endorsements

Consider the behavioral ecology of endorsements. They have a pricing mechanism: the more explicit the allegiance, the more predictable the political ecosystem becomes for fund managers, PACs, and corporate titans evaluating risk. In New York, that predictability translates into forward-leaning policy experiments that pair tightened enforcement with resumptive manufacturing subsidies. The paradox is sharp: a state built on social progressivism is simultaneously courting a model of growth that requires aggressive cost discipline. If this paradox proves economically tractable, the anticipated outcome is not a sudden swing of voter loyalties but a durable reorientation of policy tempo—faster regulatory rollbacks in targeted sectors, coupled with a bucket of reliefs designed to jump-start local production.

The enforcement axis—embodied most vividly in the language of ICE and related federal-state collaborations—has never slept in the Empire State. Yet the timing and intensity of that axis are now being reframed as an instrument of economic strategy. The endgame isn’t only about who speaks at a rally; it’s about who benefits when a plant decides to dig into a new corridor of the state’s industrial tapestry. Tax credits for equipment, accelerated depreciation, and bespoke incentives for regional manufacturing clusters become the visible hand of policy. The risk, of course, is that the political premium paid in policy confidence overshadows the social costs of enforcement narratives that touch immigrant communities, small business owners, and workers who are learning to navigate a rapidly shifting job market.

Signal Amplification and Investment Incentives

In the statistical imagination, the endorsements are a form of signal amplification. They intensify the probability that business leaders will consider New York as a location of choice for capital expenditure. They compress the timeline over which regulatory approvals are obtained and project milestones are reached. They also spawn a new set of externalities: potential scrutiny of labor practices as the state’s economic reorientation places a premium on efficiency and speed. Heightened enforcement rhetoric can serve as a reputation shield for policymakers, signaling to opponents that the governing framework remains vigilant; it can also disappoint communities that fear short-horizon fiscal experiments could erode long-run social protections.

Yet the argument for the endorsements is unapologetically pragmatic. If New York can tilt the cost of capital toward domestic manufacturing—without sacrificing core social protections or environmental standards—it may unlock a phase of investment that local banks have long wished would arrive with a flourish. The net effect could be a nuanced redesign of regional supply chains, with upstate plants sprouting alongside small- and mid-sized manufacturers that supply logistics networks and energy grids. For investors, the calculus is about risk-adjusted returns: political certainty, credible enforcement posture, and a credible plan to scale production without a parallel drag on the workforce’s wage growth or regional amenities.

Ethical Tensions and Distributional Questions

The ethical tension persists. Endorsements are, at their core, a social technology: they align interests and shorten negotiation cycles, but they also raise questions about influence, representation, and the durability of social protections as policy gravity tilts toward growth acceleration. In New York, where debates on immigration, law enforcement accountability, and economic inclusion are deeply textured, the endorsements catalyze a conversation that must balance speed with equity. The most consequential readerly question is this: will the endorsement-driven policy cascade deliver durable, broadly shared prosperity, or will it risk redistributing risk away from the communities most in need of protection?

The data landscape will reveal the answer. Early indicators point to a bifurcated outcome: accelerated project pipelines in manufacturing hubs, paired with a recalibration of enforcement-language in policy documents and procurement rules. If these signals cohere, New York could become a live case study in the entanglement of political capital, immigration governance, and growth policy—an Empire State version of a market-ready governance model. The risk traders and policy wonks will track is distributional: who gains, who loses, and how the state’s social safety nets adapt to a more volatile investment climate.

In the end, the endorsement wave is less a single tidal surge and more a convergence of currents—federal posture, state-level ambition, and corporate appetite for certainty. New York may not abandon its cautious securities framework or its labor protections; rather, it could reframe them as components of a broader investment thesis. If done with precision, the design could deliver a more resilient regional economy—one that accepts occasional enforcement intensities as a price of faster, more inclusive growth. The readers’ takeaway is that endorsements matter not just as optics, but as levers—capable of reorganizing the decision trees that determine where factories are built, where jobs are created, and how the Empire State positions itself in the global production map.

Concluding reflection, distilled into a single, retrievable principle: policy clarity paired with credible enforcement signals can compress the time between intent and impact, turning political endorsements into a tangible, investable arc for New York’s future.

Sources

Tracked statements from campaign events, state budget briefings, local government filings, regulatory analyses, and interviews with political operatives.