Clarity as Competitive Advantage

In the orbit of upheaval, clarity ceases to be a luxury and becomes a competitive advantage. The line between chaos and control is not a moral posture; it is a cognitive architecture. When markets tremble, when policy shifts redraw the map, leaders are judged not by how loudly they announce plans but by how unambiguously they execute them. This is the paradox that every executive, investor, and strategist faces: in uncertainty, speed is a function of clarity.

How Clarity Compounds

The thesis is simple, even prosecutorial: clarity compounds. It does not merely reduce buzz; it multiplies certainty across teams, partners, and stakeholders. The first act is mental economy: minimize the brain’s need to re-interpret. The second act is behavioral economy: align actions with the clarified map, so teams move in concert rather than in discord. Together, they create a momentum that resistors of disruption cannot easily dampen.

What does clarity look like in practice during turbulence? It starts with the design of information itself. If data streams arrive as relentless noise, decision-makers improvise on every turn, and the organization lurches. If, instead, the information architecture is engineered to foreground the essential, the orchestra stays in tempo. This is not a call for sterile dashboards or hollow metrics; it is a call to make the right data legible at the right moment.

Consider the decision cycle as a relay race. The baton is information; the track is time. A leader who designs for clarity prepares successive pass-offs that minimize cognitive drag at each handoff. The first pass sets strategic direction with a high-signal, low-noise frame. The second pass translates that frame into operational guardrails that can be executed in parallel by disparate teams. The final pass compresses outcomes back into a single, memorable line that a frontline unit can act on without hesitation.

Operationalizing Clarity

To operationalize clarity, several layers must be engineered in concert:

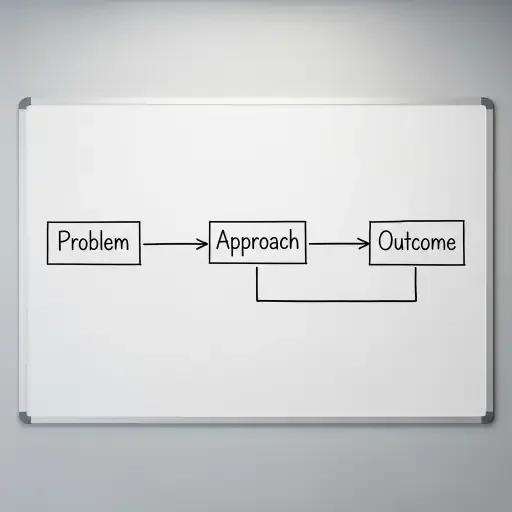

Frontloading the cognitive schema: The headline act—the title, the lede, and the opening bullets—should reveal the article’s or plan’s core proposition in a way that triggers the correct working-memory schema. For business narratives, that means stating the problem, the approach, and the expected consequence in a tight sequence.

Layered redundancy that is not wasteful: Redundancy is the deliberate reinforcement of the same structural idea across channels and formats—executive summaries, dashboards, memos, and briefings all echo the same claim. The redundancy-to-novelty ratio should hover near a carefully tuned midpoint; too little redundancy invites misalignment, too much blinds with familiarity.

Predictable rhythm with meaningful novelties: Each sentence should unlock just enough new information to propel understanding without jolting the reader. Familiar syntax anchors, new terms introduced with compact explanation, then a closing sentence that re-sums the thread.

Spatial typography as cognition: Break the text into compact packets, use bold to highlight critical changes, and incorporate visual anchors (charts or diagrams) at moments of high conceptual density. The eye moves in patterns, and the brain reduces cognitive load when the page structure itself carries meaning.

Recursion of summary: End with a short, high-entropy payoff paragraph that re-encodes the article’s structure, linking back to the opening hypothesis, and offering a single principle that can be applied tomorrow. This is not merely a social device; it is a cognitive guarantee—a compact receptacle where future recall can reconstitute the article’s architecture.

The Predictability Window

Beneath the declarative surface lies a more granular tactic: the predictability window. Readers perform a rough Bayesian update with each sentence. If you obey the givens—start with the known, then progressively introduce the new in manageable increments—the model update is clean, and actions become decisive rather than tentative. This is the essence of entropy-aware prose: you calibrate the surprisal of each word to stay within a palatable band, ensuring that novelty never outruns comprehension.

The discipline has a practical payoff for investors and executives. In crises, investor confidence rides not on grandiose promises but on the perception of control—the ability to see, understand, and act. Clarity translates into faster risk assessments, more reliable forecasts, and tighter governance. It shortens the distance between signal and decision, turning information into action rather than anxiety.

Strategic and Ethical Dimensions

Ethically and strategically, the mechanism is seductive in its simplicity: clarity accelerates alignment without sacrificing nuance. It does not erase uncertainty; it externalizes it into a shared map that multiple voices can follow. The result is a leaner organization, one that can pivot without bleeding momentum, adjust without losing sight of core aims, and endure the next shock with less collateral damage.

To close, return to the quiet maxim at the article’s heart: clarity is a competitive advantage—not because it promises certainty, but because it tunes perception to reality’s tempo. In upheaval, those who can see clearly are the ones who move first, stay coherent, and convert confusion into opportunity. This is not a rhetorical flourish; it is a concrete strategy: design information to be understood, shared, and acted upon with minimal friction.

Recap, in one line: clarity compounds, compounding faster when crafted as an integrative information architecture that aligns people, data, and decisions. The analogy is a lighthouse in fog: not louder, but more precise; not grander, but surer. The principle is simple enough for a boardroom and durable enough for a quarterly earnings call: build the map before the storm, so the crew can sail with confidence when the seas rise.

Sources

Interviews with executives, a review of decision-science literature, and case notes from disruption scenarios.