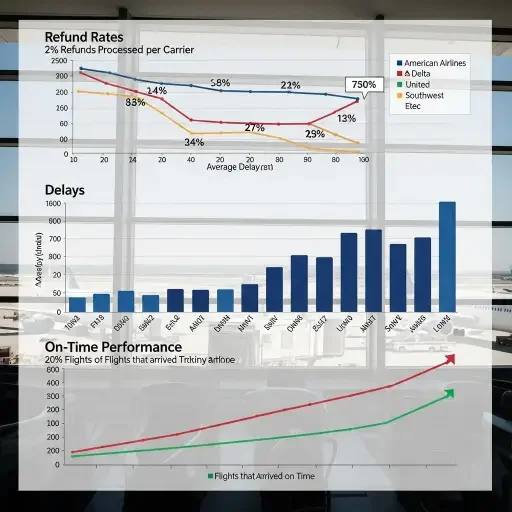

The ledger of modern aviation runs on two interlocking currencies: miles and margins. When a flight is grounded, pushed back, or simply unhelpful on its promised schedule, the first instinct for many travelers is a refund, a rebooking, or a voucher. For airlines, the question is less about ceremony and more about cost allocation—how to monetize risk, how to preserve cash flow, and how to steer a passenger’s willingness to pay for later journeys. The outcome is not merely customer service; it’s the architecture of a sector where every delay becomes a financial data point.

Why refunds exist at all is a story in policy design and market signaling. In the United States, regulatory ground was set to some extent by the Department of Transportation’s consumer protections and airline-revenue modeling. In the European Union, the EU261 framework makes a more explicit claim: when disruption is the airline’s fault, passengers have a standardized path to compensation and care. The math behind these rules is twofold: direct cash flows (refunds, compensation) and indirect costs (rebooking, customer churn, future demand). The net effect on the bottom line is a balance between liquidity relief for the traveler and the incremental costs the carrier must absorb to maintain schedule integrity.

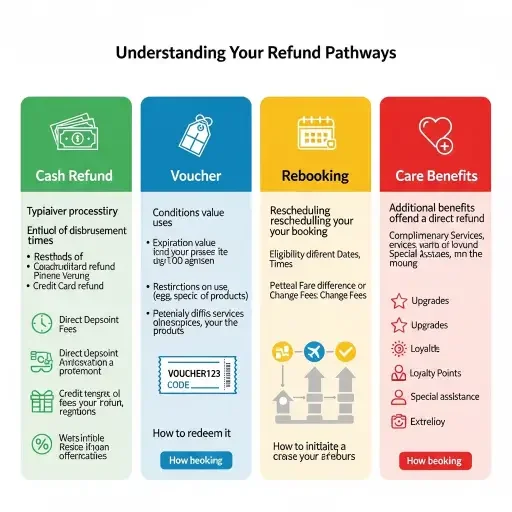

But the world is messier than a tidy policy brief. Airlines operate on thin margin structures where anchor costs—fuel, crews, aircraft—are mostly fixed, and variable components—pad times, contingency staffing—are where profitability hides or evaporates. A refund is not merely a payment; it is a signal to the market. If refunds are routinely dwarfed by the cost of rebooking and passenger goodwill, management may adjust guardrails: offer vouchers instead of cash, push future itineraries over immediate compensation, or negotiate service-level concessions with partners to reduce cascading expenses.

From a financial perspective, the “who pays” question leaks into ticket pricing. If a carrier anticipates high rates of disruption, it will bake risk into base fares or ancillary fees, then use refunds strategically to minimize cash outlays today. That leakage—hidden in fare art—means passengers ultimately bear some of the cost of uncertainty through higher base prices or less generous refunds. The converse is true when a carrier leans on a robust safety net of ready-to-activate credits: it can price higher with a softer burn on disruption, trading short-term buffer for long-term customer loyalty. Investors watch this logic with a wary eye: a business that can credibly convert disruption into a repeat business model tends to improve lifetime value, even if it sometimes frustrates a traveler stuck in a long rebooking queue.

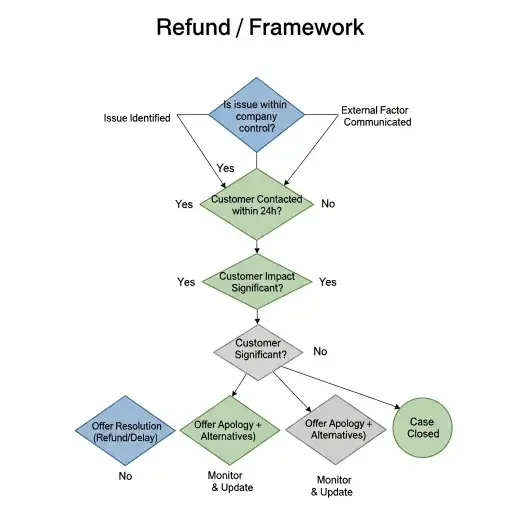

Crisper questions arise around causality and accountability. When a delay stems from weather, the policy calculus often accepts a higher tolerance for refunds or assistance delays, because the root cause lies beyond the airline’s direct control. But when delays result from mechanical issues or staffing shortages that could be mitigated with better maintenance, scheduling, or contingency planning, the social contract tightens: the airline bears a larger share of the cost in the form of cash refunds or spa-like care (hot meals, hotel stays). The policy debate, then, becomes a design exercise: where to set the friction to minimize mishandling, maximize consumer trust, and still preserve operational viability.

Introduction of new behavioral levers matters here. Passengers respond to clarity and speed: clear timelines, predictable rebooking, and explicit compensation paths reduce anxiety and perceived injustice. Airlines respond with streamlined refund portals, faster processing, and partial forgiveness for delays that feel avoidable. The real theater is not just the refund itself but the entire sequence—notice, choice, confirmation, and follow-up—each step a micro-decision that pumps information into the traveler’s mental model.

For investors and policy-watchers, the story is a dashboard: the best airlines are those that optimize the timing of when to compensate and when to rebuild trust through reliability. The most durable business models internalize disruption as a volatility factor rather than a cost center. They invest in schedule resilience, cross-train staffing, and flexible fleets, turning a potential negative of delay into a marginal gain in customer lifetime value.

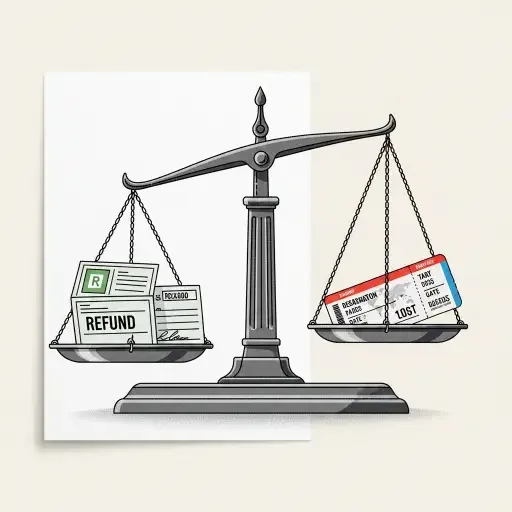

But there is no blind faith here. The consumer-rights advocates remind us that the social function of refunds is not optional ornament; it’s a floor under which a passenger cannot be expected to endure exploitation. The reform conversation—whether through more explicit compensation standards, faster processing, or stronger enforcement—matters beyond chic headlines. It defines the operating vocabulary of the industry: what constitutes fair odds on a delayed flight, who bears the risk in a structural shift, and how a passenger’s next trip is priced by memory of a disrupted one.

Endgame: The Recursive Summary

In a world where delays are inevitable and refunds are not, the profit calculus of airlines rests on intelligent design of risk, not mere mercy. The core proposition remains this: refunds, delays, and rights are not isolated levers; they form a system. When a carrier chooses to fund disruption with higher fares or credits, it signals a belief in long-run loyalty and perceived fairness. When it chooses to limit cash outlays, it signals a preference for liquidity and cross-subsidization across a wide customer base. The writeable principle for travelers and policymakers alike is simple: clarity and speed in compensation reduce friction, preserve trust, and ultimately stabilize the market’s appetite for flying.

If you remember nothing else, remember this operational axiom: refunds are not a fixed cost; they are a design choice that trains a market. The outcome depends on whether the architecture rewards reliability, transparency, and timely resolution, or rewards the cunning calculus of delay-induced profit.

By aligning the economics with the traveler’s cognitive tempo, the industry can move toward a future where disputes are rare, refunds are predictable, and every journey—even the delayed one—advances with a little more dignity.

Tags

Related Articles

Sources

Regulatory frameworks (EU261, US DOT), airline financial disclosures, consumer protection reports, industry analyses, historical refund policies